Understanding the Legal Landscape of Uninsured Motorist Claims

Car accident attorney no insurance – Navigating the aftermath of a car accident caused by an uninsured driver can feel like wading through thick mud in a Pontianak downpour – messy, frustrating, and utterly draining. But understanding the legal landscape can help you get the compensation you deserve. This guide will break down the process, offering a clearer path through the muck.

Uninsured Motorist Claim Processes

Pursuing a claim against an uninsured driver involves several key steps. First, you need to thoroughly document the accident: take photos of the damage, gather witness contact information, and obtain a police report. Next, you’ll file a claim withyour* insurance company under your uninsured/underinsured motorist (UM/UIM) coverage. This involves providing all relevant documentation to your insurer. They will then investigate the accident, assess your damages (medical bills, lost wages, property damage), and negotiate a settlement with you.

If negotiations fail, your case might proceed to litigation, where a judge or jury will decide the outcome. The entire process can be lengthy, so patience (and maybe some extra strong kopi) is crucial.

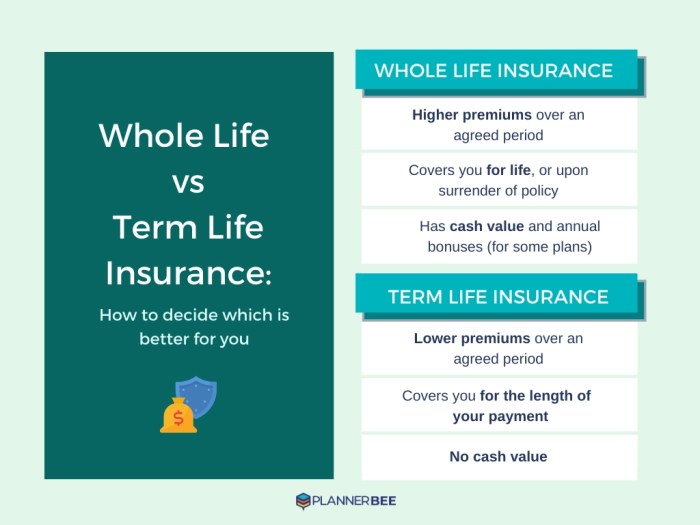

Uninsured vs. Underinsured Motorist Coverage

The difference between uninsured and underinsured motorist coverage is straightforward, yet often confusing. Uninsured motorist (UM) coverage protects you if you’re hit by a driver who has no insurance at all. Underinsured motorist (UIM) coverage steps in when you’re hit by an insured driver, but their liability coverage is insufficient to cover your losses. Imagine this: you’re in an accident, the other driver has $25,000 in liability coverage, but your medical bills alone are $50,000.

Your UIM coverage would cover the remaining $25,000. It’s like having a safety net for when the other driver’s insurance isn’t enough.

Filing a Claim with Your Insurance Company

Filing a claim is a structured process. First, promptly report the accident to your insurance company, ideally within 24-48 hours. Next, gather all necessary documentation: police report, medical records, repair estimates, photos of the damage, and witness statements. Then, complete your insurance company’s claim form accurately and thoroughly. Be prepared to answer questions about the accident and provide supporting evidence.

Finally, follow up regularly with your adjuster to check the status of your claim. Remember, clear communication is key to a smooth process.

Challenges in Dealing with Uninsured Drivers

Dealing with uninsured drivers presents unique hurdles. One major challenge is proving the other driver’s lack of insurance. This might require obtaining a copy of their driving record or contacting the state’s Department of Motor Vehicles. Another common challenge is negotiating a fair settlement. Uninsured drivers often lack the resources to compensate victims fully, leaving you to rely on your own UM coverage, which might involve lengthy negotiations with your insurer.

Finally, locating the at-fault driver can be difficult if they flee the scene or provide false information. These situations often require diligent investigation and persistence.

State-Specific Legal Requirements for Uninsured Motorist Claims

The legal landscape varies significantly across states. Some states require UM coverage, while others make it optional. Benefit limits and claim procedures also differ. The following table offers a simplified comparison (note: this is a simplified example and may not reflect all nuances of state laws; always consult a legal professional for specific details):

| State | UM Coverage Required? | Typical Benefit Limit | Claim Process Notes |

|---|---|---|---|

| California | Optional | Varies by policy | Strict deadlines for reporting |

| Texas | Optional | Varies by policy | Emphasis on comparative negligence |

| Florida | Optional | Varies by policy | Strong emphasis on documentation |

| New York | Optional | Varies by policy | No-fault insurance system impacts claims |

Gathering Evidence After an Accident Involving an Uninsured Driver

Okay, so you’ve been in a fender bender, and the other driver? No insurance*. Don’t panic, Pontianak style! We’re gonna get you through this. Gathering the right evidence is key to getting your claim paid, so let’s get organized. Think of it like a detective case, but with less trench coats and more paperwork.

Documenting the accident scene properly is absolutely crucial. It’s your first line of defense, your proof of what happened. The more thorough you are, the stronger your case becomes. No detail is too small – remember, you’re painting a picture for the insurance company (yours, or potentially the at-fault driver’s if they have an uninsured/underinsured motorist policy) and possibly a court, so make it a masterpiece.

Obtaining Police Reports and Medical Records

Getting the official police report is a must. It’s the official record of the incident, detailing what the officers observed. This report acts as an independent verification of the accident details. It includes things like the date, time, location, and descriptions of the vehicles and injuries. To get a copy, you’ll typically need to contact the police department that responded to the accident.

Medical records are equally important. They document your injuries and the treatment you received. These records provide concrete evidence of the extent of your damages. Request copies from your doctors and any other healthcare providers involved in your care. Be sure to get everything – doctor’s notes, diagnostic test results, and bills.

Crucial Evidence to Collect

Beyond the official reports, there’s a treasure trove of evidence you can gather yourself. Think of it as building your case brick by brick. Every piece counts.

- Photos and Videos: Take pictures of everything – the damage to the vehicles, the accident scene itself (road conditions, traffic signs, etc.), your injuries, and any visible damage to your property. Videos are even better, capturing the scene in real-time. Imagine a video showing the other driver’s reckless driving – that’s gold!

- Witness Statements: If there were any witnesses, get their contact information and a written statement detailing what they saw. A witness account adds a layer of credibility to your claim. The more the merrier!

- Vehicle Information: Note down the other driver’s license plate number, make, model, and color. This information is vital for identification and tracing purposes.

- Your Insurance Information: Keep your insurance policy details handy, including your policy number and coverage limits. You’ll need this for your claim.

Accident Scene Documentation Checklist

Here’s a handy checklist to ensure you’re covering all your bases at the accident scene. Remember, the more detail, the better.

| Item | Description |

|---|---|

| Photographs | Multiple angles of vehicle damage, overall scene, road conditions, traffic signs, visible injuries. Include close-ups of any significant details. |

| Video Recording | A continuous recording of the scene, including the aftermath, and if possible, the moments leading up to the accident (dashcam footage is ideal). |

| Witness Information | Names, phone numbers, addresses, and brief descriptions of what they saw. Obtain written statements if possible. |

| Police Report Number | Record the report number and officer’s name for easy reference. |

| Vehicle Information | Make, model, year, color, license plate number of all involved vehicles. |

| Environmental Conditions | Note weather conditions (rain, snow, fog), lighting, and road surface conditions. |

Sample Evidence Collection Strategy

Organize your evidence logically. A well-organized presentation is just as important as the evidence itself. Think of it as telling a story – a compelling story that supports your claim.

- Chronological Order: Arrange your evidence chronologically, starting from the moments leading up to the accident, through the accident itself, and ending with the aftermath.

- Categorization: Group similar pieces of evidence together. For example, keep all photographs in one folder, all witness statements in another, and so on.

- Clear Labeling: Clearly label all evidence with dates, times, and descriptions. This makes it easy to find and reference specific items.

- Secure Storage: Store all evidence in a safe and secure location to prevent loss or damage.

Negotiating with Insurance Companies and the Uninsured Driver

Navigating the world of insurance claims after a car accident, especially when the other driver is uninsured, can feel like wading through a swamp of paperwork and legal jargon. But don’t worry,

- abang* and

- kakak*, we’re here to help you navigate this tricky terrain with some practical advice on negotiating with insurance companies and, if necessary, the uninsured driver themselves. Remember, in Pontianak, we handle things

- sabar* and

- cerdas*.

Negotiating with insurance companies, especially after an accident involving an uninsured driver, requires a strategic approach. Insurance adjusters are trained to minimize payouts, so understanding their tactics is crucial to securing a fair settlement. Remember, your own insurance company (if you have uninsured/underinsured motorist coverage) will be your primary negotiator, but you’ll play a vital role in providing information and advocating for your interests.

Insurance Company Tactics to Minimize Payouts

Insurance companies employ various strategies to reduce their payouts. One common tactic is to downplay the severity of your injuries or damages. They might suggest your injuries are less serious than they are, or attribute them to pre-existing conditions. Another tactic is to delay the claims process, hoping you’ll give up or accept a lower settlement due to financial pressure.

They might also attempt to place blame on you, even partially, to reduce their liability. For example, they might claim you weren’t wearing your seatbelt or that you contributed to the accident. Finally, they might offer a low initial settlement hoping you’ll accept it without fully understanding the extent of your losses. It’s important to document everything meticulously, including medical bills, lost wages, and repair estimates.

Effective Negotiation Strategies for Maximizing Settlements

To counter these tactics, thorough documentation is key. Maintain detailed records of all communication with the insurance company, including emails, letters, and phone call notes. Keep copies of all medical records, bills, and repair estimates. If possible, obtain independent medical evaluations to support your claims regarding the extent of your injuries. Consider consulting with a personal injury lawyer experienced in handling uninsured motorist claims.

They can provide valuable guidance and negotiate on your behalf. A strong case built on solid evidence is your best negotiating tool. Remember to always remain calm and professional during negotiations, even when faced with frustrating tactics. A calm and reasoned approach is often more effective than an aggressive one.

Protracted Negotiations and Litigation

Negotiations can sometimes drag on for months, even years. Insurance companies often hope that the passage of time will weaken your resolve or diminish the value of your claim. If negotiations fail to reach a satisfactory settlement, litigation may become necessary. This involves filing a lawsuit and pursuing your claim through the court system. Litigation can be time-consuming and expensive, but it may be the only way to obtain a fair settlement, especially in cases involving significant injuries or damages.

For instance, a case involving severe injuries requiring extensive medical treatment and rehabilitation might necessitate litigation to fully compensate the injured party.

Common Points of Contention During Settlement Negotiations

Common points of contention often revolve around the valuation of damages. Disputes may arise over the extent of medical expenses, lost wages, pain and suffering, and property damage. Liability is another major point of contention, particularly in cases where the uninsured driver disputes responsibility for the accident. Determining the appropriate amount for pain and suffering is often subjective and can lead to lengthy negotiations.

For example, a disagreement on the value of lost future earning potential due to a permanent injury could significantly impact the final settlement.

Comparing Different Negotiation Approaches

A

- lembut* approach, focusing on building rapport and finding common ground, can be effective in some cases. This approach involves demonstrating empathy and understanding while firmly advocating for your rights. Conversely, a more assertive approach, clearly outlining your demands and highlighting the strength of your case, might be necessary if the insurance company is unwilling to negotiate fairly.

The best approach depends on the specific circumstances of your case and the attitude of the insurance adjuster. For example, a

- lembut* approach might work well with an adjuster known for being cooperative, while a more assertive approach might be needed with an adjuster known for delaying tactics and lowball offers.

The Role of a Car Accident Attorney in Uninsured Motorist Cases: Car Accident Attorney No Insurance

Dealing with a car accident is stressful enough, but when the other driver is uninsured, it feels like you’re navigating a swamp of paperwork and frustration all by yourself. That’s where a car accident attorney specializing in uninsured motorist claims becomes your lifeline, your trusted guide through the murky waters of legal battles and insurance company negotiations. They’re not just there to file paperwork; they’re your advocate, fighting for the compensation you deserve.

Benefits of Hiring an Uninsured Motorist Attorney, Car accident attorney no insurance

Hiring a specialist attorney offers significant advantages. They possess in-depth knowledge of uninsured motorist laws, insurance policies, and the intricacies of personal injury claims. This expertise allows them to build a strong case, maximizing your chances of receiving fair compensation for medical bills, lost wages, pain and suffering, and property damage. They understand the Pontianak way of dealing with these issues, knowing which tactics work best and which pitfalls to avoid.

Think of them as your personal legal “jagoan,” someone who knows the local rules of the game.

Services Provided by Uninsured Motorist Attorneys

These attorneys provide a comprehensive range of services. This includes thoroughly investigating the accident, gathering evidence (police reports, medical records, witness statements), negotiating with your own insurance company and attempting to recover from the at-fault uninsured driver, preparing and filing lawsuits if necessary, and representing you in court. They handle all the complex legal procedures, freeing you to focus on your recovery.

They’ll even deal with the

leceh* (annoying) paperwork, saving you precious time and energy.

Examples of Successful Case Outcomes

While specific case details are often confidential due to client privacy, successful outcomes frequently involve securing full policy limits from the client’s uninsured/underinsured motorist (UM/UIM) coverage. For example, a client severely injured in an accident caused by an uninsured driver might have received a settlement covering all their medical expenses, lost income, and pain and suffering, totaling hundreds of thousands of rupees, thanks to their attorney’s skillful negotiation and litigation.

Navigating a car accident without insurance can be incredibly challenging, leaving you vulnerable to significant financial burdens. Understanding your options is crucial, and researching your coverage options is key. For comprehensive car insurance comparisons, check out resources like nerdwallet com car insurance to better understand your needs. This knowledge will be invaluable when consulting a car accident attorney, especially if you’re uninsured.

Another example might involve a case where the attorney successfully proved the uninsured driver’s negligence, even in the absence of a clear admission of guilt, leading to a favorable settlement.

Navigating Complex Legal Procedures

The legal process surrounding uninsured motorist claims can be incredibly complicated. Insurance companies often employ tactics designed to minimize payouts. An attorney expertly navigates these complexities, ensuring all legal requirements are met, deadlines are adhered to, and your rights are protected. They understand the nuances of insurance law and can challenge unfair denials or low settlement offers. They’ll handle everything from filing the initial claim to appealing a denied claim, ensuring a smooth and efficient process for you.

Flowchart: Working with an Uninsured Motorist Attorney

A simplified flowchart depicting the process:[Imagine a flowchart here. The boxes would be: 1. Accident Occurs; 2. Contact Attorney; 3. Investigation & Evidence Gathering; 4.

Negotiation with Insurance Companies; 5. Filing a Lawsuit (if necessary); 6. Trial/Settlement; 7. Compensation Received. Arrows would connect each box, indicating the flow of the process.]The flowchart visually represents the attorney’s role in guiding you through each stage, from the initial accident report to the final settlement or court judgment.

They are your constant companion and advocate throughout the entire process, ensuring a fair and just outcome.

Financial Considerations and Compensation for Injuries

Getting into a car accident is already abad* vibe, especially when the other driver doesn’t have insurance. But hey, don’t panic! Understanding how you can recover your losses is key to getting back on your feet. This section breaks down the financial side of things, so you know what to expect.

In uninsured motorist claims, you can recover various types of damages to compensate for your losses. Think of it as getting back what you’ve lost due to someone else’s recklessness. This isn’t about getting rich quick; it’s about fairly covering your expenses and suffering.

Types of Recoverable Damages

Uninsured motorist claims typically cover a range of damages, aiming to put you back in the position you were in

-before* the accident. This includes medical bills, lost wages, and pain and suffering. The specifics depend on the severity of your injuries and the impact on your life.

- Medical Bills: This covers everything from doctor visits and hospital stays to medication, physical therapy, and any future medical care needed due to the accident. Think ambulance rides, surgery costs, ongoing treatments – the whole shebang.

- Lost Wages: If the accident prevented you from working, you can claim compensation for the income you lost. This includes your current salary, bonuses, and even potential future income loss if your injuries prevent you from returning to your previous job or career path.

- Pain and Suffering: This is a bit trickier to quantify, but it compensates you for the physical pain, emotional distress, and mental anguish caused by the accident. It considers the severity and duration of your pain, and how it affects your daily life. Think sleepless nights, constant discomfort, and the emotional toll of recovering from a traumatic event.

Damage Calculation Examples

Calculating damages isn’t an exact science, but here are a couple of scenarios to illustrate how it works. Remember, these are simplified examples, and your specific case will be unique.

- Scenario 1: Minor Injury A person suffers a minor whiplash injury. Medical bills total $5,000, lost wages are $1,000, and pain and suffering is estimated at $2,000 (based on the relatively short recovery time and minimal long-term effects). Total damages might be around $8,000.

- Scenario 2: Severe Injury A person suffers a broken leg requiring surgery and extensive physical therapy. Medical bills reach $50,000, lost wages are $20,000 due to several months of missed work, and pain and suffering is estimated at $30,000 due to long-term pain and disability. Total damages could be around $100,000.

Impact of Pre-existing Conditions

Pre-existing conditions can complicate things. The insurance company will try to argue that your injuries are worsened pre-existing conditions, not solely from the accident. A good attorney will work to separate the accident-related injuries from your pre-existing conditions, showing exactly what portion of your damages resulted from the accident.

Obtaining a Fair Settlement

Getting a fair settlement requires meticulous documentation and strong negotiation. Your attorney will gather all medical records, wage statements, and other evidence to build a solid case. They’ll negotiate with your insurance company and, if necessary, the uninsured driver’s insurance (if they have any other coverage) to secure the compensation you deserve. This process can involve multiple negotiations and may even lead to litigation if a fair settlement can’t be reached.

Sample Post-Accident Budget

This illustrates potential financial losses. Your actual situation will vary.

- Medical Expenses: $10,000 (Doctor visits, medication, physical therapy)

- Lost Wages: $5,000 (Missed work due to injury)

- Property Damage: $2,000 (Car repairs or replacement)

- Pain and Suffering: $7,000 (Estimated based on injury severity)

- Total Estimated Losses: $24,000

Preventing Future Accidents with Uninsured Drivers

Dealing with an uninsured driver is a nightmare, but being proactive can significantly reduce your chances of facing that situation again. Understanding how to identify potential risks, protecting yourself with proper insurance, and driving safely are crucial steps to avoid future accidents. Let’s look at some practical strategies.

Identifying Uninsured Drivers on the Road

Spotting an uninsured driver before an accident is nearly impossible. However, being aware of certain risk factors can help you exercise more caution. Drivers in older, less-maintained vehicles, or those exhibiting erratic driving behaviors (speeding, reckless lane changes) might be more likely to be uninsured, although this is not a definitive indicator. Ultimately, you can’t know for sure unless you check their insurance.

Focusing on safe driving practices remains the best preventative measure.

The Importance of Uninsured/Underinsured Motorist Coverage

Think of uninsured/underinsured motorist (UM/UIM) coverage as your safety net. It protects you and your passengers if you’re involved in an accident caused by an uninsured or underinsured driver. Without this coverage, you could be left footing the bill for your medical expenses, vehicle repairs, and lost wages, even if you weren’t at fault. Adequate UM/UIM coverage ensures you’re financially protected regardless of the other driver’s insurance status.

Consider the severity of potential injuries and repair costs when determining the appropriate coverage amount; it’s better to be over-insured than under-insured.

Safe Driving Practices to Minimize Accident Risks

Defensive driving is key. Always maintain a safe following distance, be aware of your surroundings, avoid distractions (phones, loud music), and obey traffic laws. Being alert and anticipating potential hazards, like drivers making sudden moves, helps you react proactively and avoid accidents. Regular vehicle maintenance also contributes to safer driving by preventing mechanical failures that could lead to accidents.

Resources for Verifying Driver Insurance Information

While you can’t readily verify a driver’s insurance on the spot, some states offer online databases where you can check insurance information if you have the driver’s license number and consent. However, this is usually only available after an accident. Remember, demanding insurance information from a driver at the scene is not always advisable. Instead, prioritize your safety and focus on reporting the accident to the authorities.

A Guide for Selecting Appropriate Insurance Coverage

Choosing the right insurance coverage is crucial for your financial protection. Here’s a guide to help you make informed decisions:

- Assess Your Needs: Consider the value of your vehicle, your potential medical expenses, and your lifestyle. Higher coverage limits offer greater protection.

- Understand UM/UIM Coverage: Ensure you have sufficient UM/UIM coverage to cover potential losses in an accident with an uninsured or underinsured driver. This is especially important in areas with a high percentage of uninsured drivers.

- Compare Quotes: Obtain quotes from multiple insurance providers to compare prices and coverage options. Don’t just focus on the cheapest option; consider the comprehensiveness of the coverage.

- Review Your Policy Regularly: Life changes (new car, new family members) may necessitate adjustments to your insurance coverage. Review your policy annually to ensure it still meets your needs.

- Consult an Insurance Professional: If you’re unsure about what coverage you need, consult with an independent insurance agent. They can help you navigate the complexities of insurance policies and select the right coverage for your specific situation.