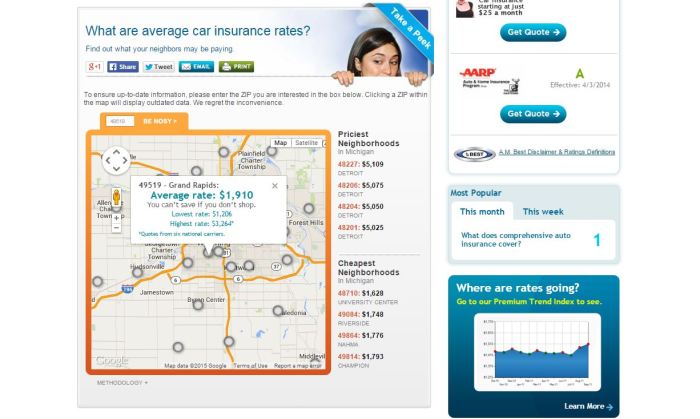

Finding Affordable Car Insurance in 78641

Car insurance 78641 – Securing affordable car insurance in zip code 78641, like anywhere else, requires a strategic approach. Understanding your options and actively engaging in the process is key to finding the best coverage at a price that works for you. This involves careful comparison shopping, exploring ways to lower your premiums, and considering the potential benefits of insurance bundling.

Comparing Car Insurance Quotes in 78641

To effectively compare car insurance quotes in 78641, utilize online comparison tools. These platforms allow you to input your information once and receive quotes from multiple insurers simultaneously, saving you considerable time and effort. Remember to provide accurate details about your vehicle, driving history, and desired coverage levels to ensure the quotes you receive are truly representative of your needs.

Don’t hesitate to contact insurers directly to clarify any details or ask questions about specific policy features. This direct interaction can often unearth additional discounts or uncover policies better suited to your individual circumstances.

Strategies to Lower Car Insurance Costs in 78641

Several strategies can help lower your car insurance costs. Maintaining a good driving record is paramount; accidents and traffic violations significantly impact premiums. Consider increasing your deductible; a higher deductible generally results in lower premiums, but be sure you can comfortably afford the increased out-of-pocket expense in case of an accident. Opting for a less expensive car model can also reduce your premiums, as insurance costs are often tied to the vehicle’s value and repair costs.

Bundling your car insurance with other types of insurance, such as homeowners or renters insurance, can often lead to significant savings through multi-policy discounts. Finally, explore discounts offered by insurers. Many offer discounts for good students, safe drivers, and those who complete defensive driving courses.

Benefits and Drawbacks of Bundling Car Insurance

Bundling car insurance with other insurance policies, such as homeowners or renters insurance, offers several advantages. The most significant is the potential for substantial discounts. Insurers often reward policyholders who bundle their coverage by offering lower premiums than if the policies were purchased separately. This can result in significant cost savings over the long term. However, bundling isn’t always the best option.

If you find better rates from separate insurers for your different coverage needs, bundling might not be the most cost-effective choice. Carefully compare bundled rates with rates from individual insurers before making a decision.

Obtaining Car Insurance in 78641: A Step-by-Step Guide

Obtaining car insurance in 78641 follows a straightforward process. First, gather necessary information: driver’s license, vehicle information (make, model, year), and details of your driving history. Next, use online comparison tools or contact insurance agents directly to obtain quotes. Carefully review the quotes, paying close attention to coverage limits, deductibles, and premiums. Once you’ve selected a policy, provide the insurer with the required information and complete the application process.

Finally, pay your first premium and receive your insurance card. Remember to keep your policy information updated, particularly if you change vehicles or addresses.

Illustrative Scenarios in 78641: Car Insurance 78641

Understanding car insurance in 78641 requires looking at real-world examples. This section provides scenarios illustrating how insurance works in practice, highlighting different coverage options and their costs. We’ll explore situations faced by various drivers and the impact of insurance choices.

Young Driver Seeking Affordable Car Insurance, Car insurance 78641

Maria, a recent college graduate in 78641, is looking to buy her first car. Being a new driver, she faces higher insurance premiums. To find affordable coverage, Maria shops around, comparing quotes from different insurers. She considers liability-only coverage initially, as it’s the most affordable option, but understands that it only protects others in an accident, not herself or her vehicle.

She carefully weighs the cost versus the risk and ultimately decides on a minimum liability policy supplemented with collision coverage to protect her new car investment. This allows her to balance affordability with some level of personal protection.

Hypothetical Accident Scenario and Coverage Application

Imagine Maria is involved in an accident. Another driver runs a red light and hits her car. The other driver is at fault. If Maria only had liability coverage, her own vehicle damage wouldn’t be covered. However, her liability coverage would pay for the other driver’s medical bills and vehicle repairs.

If she had collision coverage, her own car repairs would be covered, less her deductible. Comprehensive coverage, which she didn’t have, would have covered damage from events other than collisions, such as hail or vandalism. Uninsured/underinsured motorist coverage would protect Maria if the at-fault driver lacked sufficient insurance.

Cost Differences Between Coverage Levels for a Sedan

The following table illustrates the estimated monthly premiums for different coverage levels on a 2020 Honda Civic in 78641, for a driver with Maria’s profile (young driver, clean driving record). These are illustrative examples and actual costs will vary depending on the insurer and specific circumstances.

| Coverage Level | Liability Only | Liability + Collision | Liability + Collision + Comprehensive | Liability + Collision + Comprehensive + Uninsured/Underinsured |

|---|---|---|---|---|

| Estimated Monthly Premium | $80 | $120 | $150 | $180 |

Typical Car Insurance Claim Process

Filing a car insurance claim in 78641 typically involves these steps: First, report the accident to the police and your insurance company immediately. Next, gather information at the accident scene: take photos of the damage, get contact information from witnesses and the other driver, and note the location and time of the accident. Then, file a claim with your insurer, providing all relevant documentation.

Your insurer will investigate the accident, assess the damage, and determine liability. Once liability is established, the insurer will process your claim, potentially covering repairs, medical bills, or other expenses according to your policy coverage. You may need to pay your deductible before receiving compensation. The entire process can take several weeks or even months, depending on the complexity of the claim.

Finding the right car insurance in 78641 can be a breeze! You need to be organized, just like electricians who use a great CRM system to manage their jobs, like this awesome crm for electrician system. So, after you’ve sorted out your car insurance needs in 78641, remember to stay organized with your other important stuff too!