Frisco Car Insurance Market Overview

Car insurance frisco – A grey landscape, the Frisco car insurance market, stretches before us, a tapestry woven with threads of competition and cost. The city’s growth, a relentless hum, echoes in the premiums paid, a constant reminder of risk and reward. Each policy, a fragile promise against the unforeseen.

The competitive landscape is a crowded stage, where established giants and nimble newcomers vie for the attention of Frisco drivers. The familiar names, the reassuring logos, promise security, but the reality is a complex dance of coverage and price. A driver’s journey through this market is often fraught with uncertainty, a search for the perfect balance between protection and affordability.

Major Insurance Providers in Frisco

Several major insurance providers hold significant market share in Frisco, each offering a slightly different blend of coverage and price points. These companies, often national players, have established themselves through extensive marketing and a broad range of product offerings. Their presence shapes the market dynamics, influencing the types of policies available and the overall cost of insurance.

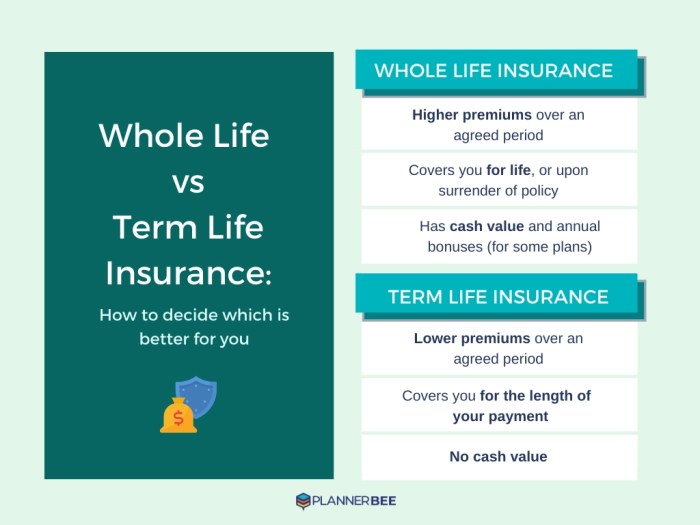

Types of Car Insurance Policies Offered in Frisco

The spectrum of car insurance policies available in Frisco mirrors the national landscape, offering a variety of coverage options to cater to different needs and risk profiles. From basic liability coverage to comprehensive plans, drivers have a range of choices to navigate. The selection often involves a careful weighing of costs against the level of protection desired, a delicate balancing act against the uncertainties of the road.

Average Cost of Car Insurance in Frisco

The cost of car insurance in Frisco varies significantly based on individual driver profiles, reflecting the complex interplay of risk factors and market forces. Younger drivers, for instance, often face higher premiums due to their statistically higher accident rates. Driving history plays a pivotal role, with spotless records rewarded with lower costs, while accidents and violations can significantly increase premiums.

The following table illustrates the diverse cost landscape.

The whispers in Frisco about unusually low car insurance rates felt… unsettling. A peculiar chill accompanied each quote, hinting at something more than just competitive pricing. To understand the full picture, one must broaden their search and consider the wider Texas landscape; finding the best deal requires exploring all options, so start by visiting shop for car insurance in texas to compare.

Only then can the true nature of those Frisco rates be deciphered.

| Provider | Policy Type | Average Cost | Key Features |

|---|---|---|---|

| Progressive | Liability | $800/year | Basic coverage, affordable option |

| State Farm | Comprehensive | $1500/year | Broad coverage, higher deductible |

| Geico | Full Coverage | $1800/year | Extensive coverage, lower deductible |

| USAA | Liability + Uninsured Motorist | $1200/year | Targeted at military personnel and families, strong reputation |

These figures are estimates and may vary based on specific circumstances. Each driver’s profile, a unique constellation of factors, shapes their individual cost. The market, a vast and unforgiving sea, presents a unique challenge to every navigator.

Factors Influencing Car Insurance Rates in Frisco: Car Insurance Frisco

The cost of car insurance in Frisco, like a somber melody, is woven from a tapestry of factors, each thread contributing to the final, often unpredictable, price. It’s a complex song, one that requires careful listening to understand its nuances. The seemingly arbitrary numbers assigned to our policies are, in fact, reflections of our individual risks, assessed through a lens of statistical probability and actuarial science.Driving history casts a long shadow on insurance premiums.

A clean record, like a clear, starlit night, brings lower rates, while accidents and violations, like storm clouds gathering, darken the outlook. Each incident is weighed, its severity and frequency contributing to a higher premium. A single at-fault accident might increase premiums significantly, while multiple incidents or serious offenses could lead to substantial increases, or even policy cancellation.

The haunting specter of a DUI conviction, for instance, could lead to years of elevated premiums, a constant reminder of a past mistake.

Driving History’s Impact on Premiums

The impact of driving history on car insurance premiums in Frisco is substantial. Insurance companies meticulously track driving records, assigning points for accidents, speeding tickets, and other infractions. These points directly influence the risk assessment and, consequently, the premium. For example, a driver with a history of multiple speeding tickets might face a premium increase of 20-30% compared to a driver with a clean record.

Similarly, a driver involved in a serious at-fault accident could experience a much more significant increase, potentially doubling their premiums. This system operates under the principle that a driver’s past behavior is a strong predictor of future behavior.

Vehicle Type and Value’s Role in Determining Costs, Car insurance frisco

The type and value of the vehicle significantly influence insurance costs. Luxury cars and high-performance vehicles, symbols of affluence and speed, typically command higher premiums due to their higher repair costs and greater potential for damage. Conversely, smaller, less expensive vehicles usually attract lower premiums. The inherent risk associated with driving a powerful sports car, compared to a compact sedan, is reflected in the insurance rate.

Think of it as the difference between a delicate porcelain doll and a sturdy wooden toy – the risk of breakage, and the cost of repair, are vastly different.

Location’s Influence on Insurance Rates

Location within Frisco plays a surprisingly significant role. Zip codes, often invisible markers on maps, represent distinct neighborhoods with varying risk profiles. Areas with higher rates of accidents or theft, like a mournful ballad echoing through the city, will result in higher insurance premiums for residents. This is because insurance companies use statistical data from each zip code to assess the likelihood of claims within that area.

A neighborhood known for its high crime rate or congested traffic might lead to significantly higher premiums than a quieter, safer area.

Credit Scores and Car Insurance Premiums

The seemingly unrelated factor of credit score can also significantly impact car insurance premiums in Frisco. Insurance companies use credit scores as an indicator of risk, reasoning that individuals with poor credit management might also be more likely to take financial risks in other areas of their lives, including driving. This practice, while controversial, is legal in many states and is based on statistical correlations between credit scores and insurance claims.

A lower credit score, a symbol of financial struggle, often translates to higher premiums, adding another layer of complexity to the already intricate process of securing car insurance.

Illustrative Scenarios

The bustling streets of Frisco, a tapestry woven with ambition and dreams, sometimes unravel in the harsh reality of accidents. These scenarios, though fictional, echo the anxieties and consequences that real Frisco residents face, highlighting the crucial role of car insurance in navigating life’s unpredictable turns. Understanding these scenarios can illuminate the value of different coverage options and the importance of responsible driving.

Rear-End Collision and Coverage Options

Imagine a typical Frisco afternoon. Rush hour traffic crawls along the Dallas North Tollway. A sudden brake check sends your car hurtling into the vehicle ahead. This rear-end collision, a common occurrence in congested areas like Frisco, could result in significant damage to both vehicles and potential injuries. Liability coverage would pay for the other driver’s damages, such as vehicle repairs and medical expenses, up to your policy’s limits.

Collision coverage, however, would cover your own vehicle’s repairs, regardless of fault. Comprehensive coverage might also come into play if the accident was caused by something other than a collision, like a pothole. Uninsured/Underinsured motorist coverage becomes critical if the at-fault driver lacks sufficient insurance. The extent of your financial responsibility and the compensation you receive would significantly depend on the specific coverage options included in your policy.

Comprehensive vs. Liability Coverage: A Hypothetical Scenario

A hailstorm, a common occurrence in Texas, pummels your car while parked in your Frisco driveway, causing thousands of dollars in damage. Liability insurance, designed to protect you from damages you cause to others, wouldn’t cover this. However, comprehensive coverage would step in, covering the cost of repairs or replacement. Conversely, if you were at fault in an accident causing injury to another driver and substantial damage to their vehicle, liability coverage would be crucial to protect you from potentially devastating financial consequences.

Without adequate liability coverage, you could face significant personal liability, potentially leading to bankruptcy. The contrast underscores the need to consider your personal risk tolerance and choose coverage that aligns with your needs and financial stability.

Impact of a DUI on Car Insurance Premiums

The quiet hum of a Frisco evening is shattered by flashing lights. A DUI conviction, a grim reminder of the consequences of irresponsible choices, follows. This single event will dramatically impact your insurance premiums. Insurance companies view DUI convictions as significant risk factors. Expect a substantial increase in your premiums, potentially lasting for several years, reflecting the elevated risk you pose to them.

The cost of this mistake extends far beyond the immediate legal penalties. It casts a long shadow over your financial stability, leaving a lasting mark on your insurance history.

Filing a Claim with a Frisco Car Insurance Provider

The aftermath of an accident can be overwhelming. A structured approach to filing a claim can ease the burden.

- Immediately report the accident to the police and obtain a copy of the accident report.

- Contact your insurance provider as soon as possible, providing all relevant details.

- Gather information from all parties involved, including contact details, insurance information, and witness statements.

- Take photographs and videos of the accident scene, documenting vehicle damage and any injuries.

- Follow your insurance provider’s instructions regarding repair and medical treatment, submitting all necessary documentation promptly.

This methodical approach will significantly aid in a smoother claim process, offering a degree of solace during a challenging time.