Understanding Car Insurance in Vandalia, Illinois

Car insurance vandalia – Vandalia, Illinois, presents a relatively straightforward car insurance landscape, influenced by its small-town character and demographics. Factors such as population density, average income, and driving habits within the community directly impact insurance premiums and coverage options available to residents. Understanding these factors is key to securing the most suitable and cost-effective car insurance policy.

Car Insurance Premiums in Vandalia, Car insurance vandalia

Average car insurance premiums in Vandalia are generally lower than those found in larger metropolitan areas across Illinois. This is largely due to lower population density, resulting in less traffic congestion and a statistically lower incidence of accidents. While precise figures fluctuate based on provider and individual risk profiles, comparing Vandalia’s rates to neighboring towns like Greenville or Effingham reveals a slight but consistent difference.

Statewide averages typically exceed those found in Vandalia, reflecting the higher risk associated with larger cities and their associated traffic patterns. Specific comparisons require consulting individual insurance provider websites or obtaining quotes.

Common Car Insurance Coverage in Vandalia

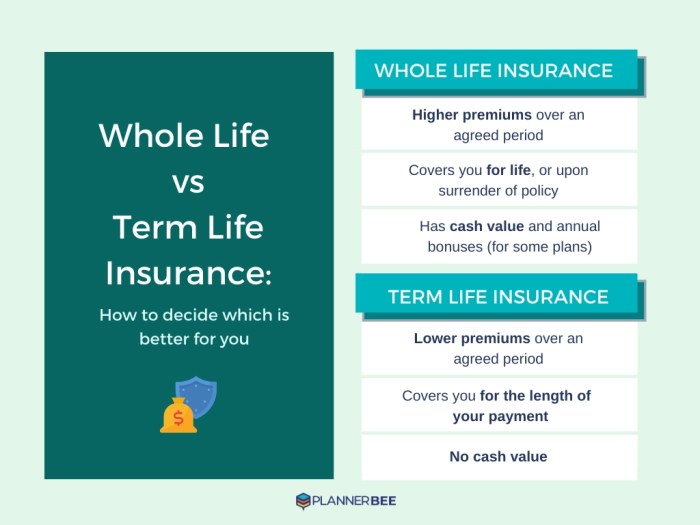

The types of car insurance coverage available in Vandalia are consistent with those offered statewide. These include liability coverage (bodily injury and property damage), collision coverage (damage to your own vehicle), comprehensive coverage (damage from non-collision events like theft or vandalism), uninsured/underinsured motorist coverage (protection against drivers without sufficient insurance), and personal injury protection (PIP) coverage (medical expenses and lost wages).

The specific coverage options and limits chosen by an individual will influence the final premium.

Comparison of Car Insurance Providers in Vandalia

The following table provides a comparison of four major car insurance providers commonly operating in Vandalia. Note that these are average rates and customer reviews and may vary based on individual circumstances and policy details. Always obtain personalized quotes from multiple providers before making a decision.

| Provider | Average Annual Premium | Customer Satisfaction (out of 5 stars) | Notable Features |

|---|---|---|---|

| State Farm | $1200 (estimated) | 4.2 | Wide agent network, various discounts |

| GEICO | $1100 (estimated) | 4.0 | Competitive online rates, strong customer service |

| Progressive | $1300 (estimated) | 3.8 | Name Your Price® Tool, many coverage options |

| Allstate | $1250 (estimated) | 4.1 | Strong reputation, various bundled options |

Factors Affecting Car Insurance Rates in Vandalia

Securing affordable car insurance in Vandalia, Illinois, depends on several key factors. Understanding these factors can help you make informed decisions and potentially save money on your premiums. This section details how various aspects of your profile and driving habits influence your insurance costs.

Driving History’s Impact on Premiums

Your driving record significantly impacts your car insurance rates in Vandalia. Insurance companies view a clean driving history as a low-risk profile, leading to lower premiums. Conversely, accidents and traffic violations increase your risk profile and result in higher premiums. For instance, a driver with multiple at-fault accidents will likely face substantially higher rates than a driver with a spotless record.

The severity of the accident also plays a role; a minor fender bender will have less impact than a serious collision. Similarly, speeding tickets, reckless driving citations, or DUI convictions significantly raise premiums due to the increased risk they represent. Many insurance companies use a points system to track driving infractions, with each point increasing your premium.

Age and Gender Influence on Insurance Costs

Age and gender are statistically significant factors influencing car insurance rates. Younger drivers, particularly those under 25, generally pay higher premiums due to statistically higher accident rates in this demographic. Insurance companies perceive this group as higher risk. As drivers age and gain experience, their premiums tend to decrease. Gender also plays a role, although the specifics vary between insurance companies and states.

Historically, male drivers, especially young males, have been statistically associated with higher accident rates than female drivers, leading to potentially higher premiums for men.

Vehicle Type and Value’s Role in Determining Rates

The type and value of your vehicle are key factors determining your insurance costs. Sports cars and high-performance vehicles are typically more expensive to insure due to their higher repair costs and greater potential for theft. Conversely, smaller, less expensive vehicles usually have lower insurance premiums. The vehicle’s value also matters; a newer, more expensive car will generally have higher premiums than an older, less valuable car because the insurance company faces higher replacement costs in the event of a total loss.

Other Factors Affecting Car Insurance Premiums

Beyond driving history, age, gender, and vehicle type, other factors influence your car insurance rates in Vandalia. Your credit score can impact your premiums, with good credit often leading to lower rates. This is because insurance companies use credit scores as an indicator of overall responsibility and risk assessment. Your location within Vandalia can also affect your rates.

Areas with higher crime rates or a greater frequency of accidents may have higher insurance premiums due to increased risk. Finally, the type of coverage you choose (liability, collision, comprehensive) will directly impact your premium; more comprehensive coverage equates to higher premiums.

Finding the Best Car Insurance in Vandalia

Securing the best car insurance in Vandalia requires careful comparison and informed decision-making. By employing effective strategies and utilizing available resources, you can find a policy that offers comprehensive coverage at a competitive price. This section provides a structured approach to navigating the car insurance market in Vandalia.

Comparing Car Insurance Quotes

Comparing quotes from multiple providers is crucial for finding the best value. Don’t just focus on the price; examine the coverage details, deductibles, and customer service reputation of each company. Consider using online comparison tools to streamline the process. These tools allow you to input your information once and receive multiple quotes simultaneously, saving you significant time and effort.

Remember to compare apples to apples – ensure all quotes are based on the same coverage levels and deductibles before making a decision.

Obtaining Car Insurance Quotes: A Step-by-Step Guide

- Gather Your Information: Compile necessary details such as your driver’s license number, vehicle information (year, make, model), driving history (including accidents and violations), and desired coverage levels.

- Utilize Online Comparison Tools: Several websites, such as those offered by insurance comparison services, allow you to input your information and receive multiple quotes instantly. These tools often include filters to refine your search based on specific needs and preferences.

- Contact Insurance Providers Directly: Reach out to individual insurance companies operating in Vandalia. You can find their contact information on their websites or through online directories. Request quotes directly from their agents or through online quote forms.

- Review and Compare Quotes: Carefully analyze each quote, paying attention to the coverage details, premiums, deductibles, and any additional fees. Don’t solely focus on the lowest price; consider the overall value and reputation of the insurer.

- Choose a Policy: Once you’ve compared quotes and identified the best option for your needs, select the policy and complete the application process.

Questions to Ask Insurance Agents

Before committing to a policy, it’s essential to clarify any uncertainties with an insurance agent. Examples of pertinent questions include: What specific coverages are included in the policy? What is the claims process like? What are the options for paying premiums? What discounts are available?

How is customer service handled? What is the company’s financial stability rating? These inquiries ensure you understand the policy’s terms and the insurer’s responsiveness.

Resources for Researching Car Insurance Options

Vandalia residents have access to various resources to research car insurance options. The Illinois Department of Insurance website provides valuable information on insurance regulations and consumer protection. Independent review sites and consumer reporting agencies often publish ratings and reviews of insurance companies, offering insights into customer satisfaction and claims handling. Additionally, local insurance brokers can provide personalized guidance and assistance in navigating the insurance market.

Specific Insurance Needs in Vandalia: Car Insurance Vandalia

Protecting yourself and your vehicle in Vandalia requires a comprehensive insurance plan tailored to the specific risks you face. Understanding your local needs ensures you have the right coverage at the right price. This section details essential coverages and additional options to consider for optimal protection.

Uninsured/Underinsured Motorist Coverage in Vandalia

Uninsured/underinsured motorist (UM/UIM) coverage is crucial in Vandalia, as it protects you from financial ruin if you’re involved in an accident caused by a driver without adequate insurance or who is uninsured. Illinois law requires minimum liability coverage, but many drivers operate with less than sufficient insurance to cover significant medical bills or property damage. UM/UIM coverage compensates you for your medical expenses, lost wages, and property damage even if the at-fault driver is uninsured or underinsured.

Consider increasing your UM/UIM limits beyond the state minimum to ensure comprehensive protection. A real-life example would be a collision with an uninsured driver resulting in significant medical bills and vehicle repair costs; UM/UIM would cover these expenses.

Comprehensive and Collision Coverage in Vandalia

Vandalia, like any other community, faces risks of vehicle damage from various sources. Comprehensive coverage protects your vehicle against damage caused by events other than collisions, such as hailstorms, theft, vandalism, or fire. Collision coverage protects your vehicle in the event of an accident, regardless of fault. Considering potential weather events and the possibility of theft or vandalism, comprehensive and collision coverage provides essential peace of mind.

For instance, a hailstorm could cause significant damage to your vehicle, and comprehensive coverage would cover the repair costs. Similarly, collision coverage would pay for repairs if you were involved in an accident, even if you were not at fault.

Roadside Assistance Coverage in Vandalia

Roadside assistance coverage can prove invaluable in Vandalia, offering peace of mind in case of unexpected vehicle troubles. Features such as towing, flat tire changes, jump starts, and lockout service can save you time, money, and stress in emergencies. Imagine a scenario where your car breaks down on a busy highway; roadside assistance would quickly dispatch help, getting you safely back on the road or to a repair shop.

This is especially beneficial for drivers who frequently travel on less-traveled roads or during late hours.

Additional Coverage Options for Vandalia Drivers

A number of additional coverage options can enhance your insurance protection:

- Rental Car Reimbursement: Covers the cost of a rental car while your vehicle is being repaired after an accident or due to damage covered by your policy.

- Gap Insurance: Covers the difference between your vehicle’s actual cash value and the amount you still owe on your auto loan if your vehicle is totaled.

- Medical Payments Coverage: Pays for medical expenses for you and your passengers, regardless of fault, up to the policy limit.

- Uninsured Property Damage: Covers damage to your vehicle caused by an uninsured driver.

These additional coverages can significantly reduce your out-of-pocket expenses in the event of an accident or other unforeseen circumstances. Choosing the right combination depends on your individual needs and risk tolerance.

Illustrative Examples of Car Insurance Scenarios in Vandalia

Understanding real-life scenarios helps illustrate the importance of adequate car insurance coverage in Vandalia. These examples highlight how different policies respond to various situations and the potential financial implications of underinsurance.

Minor Accident Scenario in Vandalia

Imagine you’re driving in Vandalia and are involved in a minor fender bender. Your car sustains $2,000 in damage, and the other vehicle has $1,500 worth of damage. With a comprehensive and collision insurance policy with a $500 deductible, your insurance would cover $1,500 of your vehicle’s repair costs. You would be responsible for the remaining $500 deductible.

Liability coverage would typically cover the other driver’s damages. However, if you only had liability coverage, you would be responsible for the full $2,000 in repairs to your vehicle. A higher deductible would mean a lower premium, but a greater out-of-pocket expense in case of an accident. Conversely, a lower deductible would result in a higher premium but lower out-of-pocket costs.

Filing a Claim with an Insurance Company in Vandalia

Let’s say you’ve been involved in an accident and need to file a claim. First, contact your insurance company immediately. Report the accident, providing all necessary details such as the date, time, location, and the other driver’s information. Next, gather evidence like photos of the damage, police reports (if applicable), and witness statements. Your insurance company will guide you through the claims process, which typically involves completing claim forms and providing supporting documentation.

They may also arrange for vehicle repairs or total loss assessments. Be prepared to answer questions about the accident and provide any requested information promptly. Failure to cooperate fully may impact your claim processing. The entire process may take several weeks to complete, depending on the complexity of the claim and the insurance company’s workload.

Benefits of Adequate Insurance Coverage in Vandalia

Consider a scenario where you cause an accident resulting in significant injuries to another person. Without adequate liability coverage, you could face substantial medical bills, legal fees, and potential lawsuits far exceeding your assets. Comprehensive insurance coverage can also protect you from financial losses due to theft, vandalism, or damage caused by events like hailstorms or falling trees.

Unforeseen circumstances, like a deer colliding with your vehicle, can result in expensive repairs. Adequate insurance coverage provides peace of mind, ensuring you’re financially protected against unforeseen events. It safeguards your financial stability and prevents catastrophic losses.

Financial Consequences of Inadequate Car Insurance Coverage in Vandalia

Suppose you only carry minimum liability coverage and cause an accident resulting in $50,000 in medical bills for the other driver. Your minimum liability coverage might only cover a fraction of this amount, leaving you personally liable for the remaining balance. This could lead to significant financial hardship, including wage garnishment, liens on your property, and even bankruptcy.

In Vandalia, as in other areas, driving without insurance or with inadequate coverage carries legal penalties, including fines and license suspension. The financial burden of an accident without sufficient insurance can be devastating, potentially impacting your credit score and future financial prospects for years.