Software Selection and Implementation: Crm Accounting Software Small Business

Crm accounting software small business – Choosing the right CRM accounting software is like picking the perfect pair of shoes – you need something comfortable, stylish, and that actually fits your needs. Don’t just grab the first shiny option you see; a little careful consideration will save you a lot of headaches (and maybe even some blisters) down the line.Selecting and implementing CRM accounting software involves a strategic approach, encompassing careful evaluation, seamless data migration, efficient system integration, and rigorous success assessment.

Ignoring any of these steps can lead to significant problems, from data loss to frustrated employees.

Software Selection Criteria

Before you even think about installing anything, you need a clear picture of what you’re looking for. This isn’t about picking the software with the flashiest interface; it’s about finding the best fit for your business’s specific requirements. Consider factors such as the size of your business, the number of users, the level of customization needed, and, crucially, your budget.

A comprehensive analysis of these factors will streamline the selection process and prevent future compatibility issues.

- Scalability: Can the software grow with your business? Imagine your company booming – will your software handle the increased workload, or will it buckle under the pressure like a cheap folding chair?

- Integration Capabilities: Does it play nicely with your existing systems (like your payroll software or e-commerce platform)? A software clash is a recipe for disaster.

- User-Friendliness: Is the interface intuitive and easy to navigate? You don’t want your employees spending hours trying to figure out how to use it. A user-friendly interface will ensure a smooth workflow and maximize productivity.

- Reporting and Analytics: Does it provide insightful reports that help you make data-driven decisions? Think of it as your business’s crystal ball – the better the reports, the clearer your vision of the future.

- Customer Support: What kind of support does the vendor offer? Having a reliable support team is like having a safety net – you’ll need it when things go wrong (and they inevitably will).

Data Migration Strategies

Moving your data from your old system to your new CRM accounting software is a critical step. Think of it as moving house – you don’t want to lose any of your precious belongings (or customer data!). A well-planned data migration minimizes disruption and ensures data integrity.

- Data Cleansing: Before you even start the migration, clean up your existing data. Remove duplicates, fix inconsistencies, and ensure accuracy. This is like decluttering your house before you move – it makes the process much smoother.

- Data Mapping: Map your old data fields to the new software’s fields. This ensures that your data is transferred correctly and that you don’t lose any information. It’s like creating a detailed inventory of your belongings before moving.

- Testing: Test the migration process thoroughly before going live. This helps to identify and fix any problems before they affect your business operations. This is similar to a trial run of your move – it helps you iron out any unexpected issues.

- Backup and Recovery: Always back up your data before and after the migration. This is your insurance policy in case something goes wrong. Think of it as taking photos of your belongings before moving – you’ll have a record of everything.

Challenges of System Integration

Integrating your CRM accounting software with existing systems can be tricky. Different systems often use different data formats and communication protocols, which can lead to compatibility issues. Think of it as trying to fit square pegs into round holes – it’s not going to be easy. Thorough planning and testing are essential to avoid potential problems. Consider using an integration platform or hiring a specialist to help with the process.

A smooth integration can save time and money in the long run. For example, a poorly integrated inventory system could lead to inaccurate stock levels and lost sales.

CRM Accounting Software Implementation Success Checklist

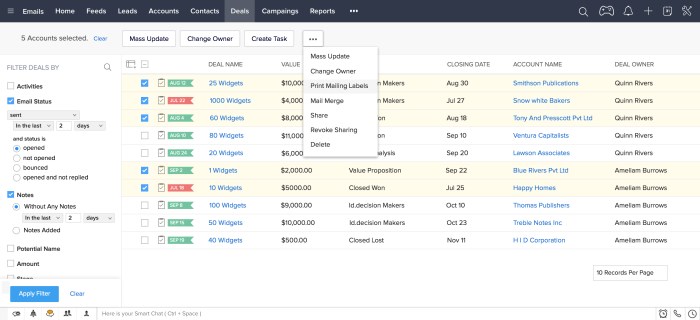

After the implementation, you need to make sure everything is running smoothly. This checklist will help you assess the success of your implementation.

- User Adoption: Are your employees using the software effectively? Low user adoption means your investment might be wasted.

- Data Accuracy: Is your data accurate and reliable? Inaccurate data leads to poor decision-making.

- Process Efficiency: Has the software improved your business processes? If not, you might need to tweak your implementation strategy.

- Return on Investment (ROI): Are you seeing a return on your investment in the software? This is the ultimate measure of success.

- Ongoing Support: Do you have a plan for ongoing support and maintenance? This ensures the long-term success of your implementation.

Optimizing Workflow and Productivity

Say goodbye to the chaotic jumble of spreadsheets and sticky notes! CRM accounting software isn’t just about numbers; it’s about liberating your business from the tyranny of administrative tasks, freeing you up to focus on what truly matters: growing your empire. This section dives into how the right software can supercharge your workflow and boost productivity to levels you never thought possible.CRM accounting software transforms the often-painful processes of invoicing and payment processing into a streamlined, efficient ballet of automation.

Imagine a world where invoices are generated with the click of a button, payments are tracked automatically, and chasing overdue invoices feels like a distant, unpleasant memory.

Streamlined Invoicing and Payment Processing

Implementing CRM accounting software drastically reduces the time and effort spent on invoicing. The software automates invoice generation, reducing manual data entry errors and ensuring consistent branding. It also simplifies the tracking of payments, providing real-time updates on outstanding invoices and automating reminders to clients, thereby minimizing late payments. For example, a small bakery using such software could generate hundreds of invoices per month automatically, eliminating the need for manual creation and significantly reducing administrative overhead.

This frees up valuable employee time for tasks that generate more revenue, like creating delicious pastries. Furthermore, integrated payment gateways allow for online payments, providing immediate confirmation and reducing the reliance on checks or manual bank reconciliations. The bakery, for instance, could see a significant reduction in bounced checks and a quicker turnaround on payments.

Workflow Diagram for Customer Relationship and Finance Management

Imagine a flowchart. It begins with a “New Customer Inquiry” box, leading to a “Customer Information Capture” box within the CRM software. This data is then used to generate a “Proposal/Quote,” which, upon acceptance, flows into an “Invoice Generation” box (automated by the software). The “Payment Received” box follows, automatically updating the customer’s account and triggering any necessary follow-up actions (e.g., order fulfillment, sending a thank you note).

A separate branch from “Customer Information Capture” leads to “Customer Communication Management” (e.g., email marketing, personalized offers), feeding back into “New Customer Inquiry” through customer loyalty and repeat business. Finally, the system generates various reports on sales, finances, and customer behavior, feeding back into the entire process to inform strategic decisions. This visualization highlights how CRM software seamlessly integrates customer relationship management with financial processes, offering a holistic view of the business.

Bottlenecks Addressed by CRM Accounting Software

Many small businesses struggle with manual data entry, leading to errors, inconsistencies, and wasted time. CRM accounting software eliminates this bottleneck by centralizing all customer and financial data. Another common problem is inefficient communication and a lack of visibility into customer interactions. The software addresses this by providing a centralized communication platform and detailed customer interaction histories. Poor invoice management and payment tracking often result in late payments and cash flow issues.

The software resolves this through automated invoicing, payment reminders, and real-time payment tracking. Finally, the difficulty in generating insightful reports to inform business decisions is a major challenge. CRM accounting software provides a wide range of customizable reports to track key performance indicators and make data-driven decisions.

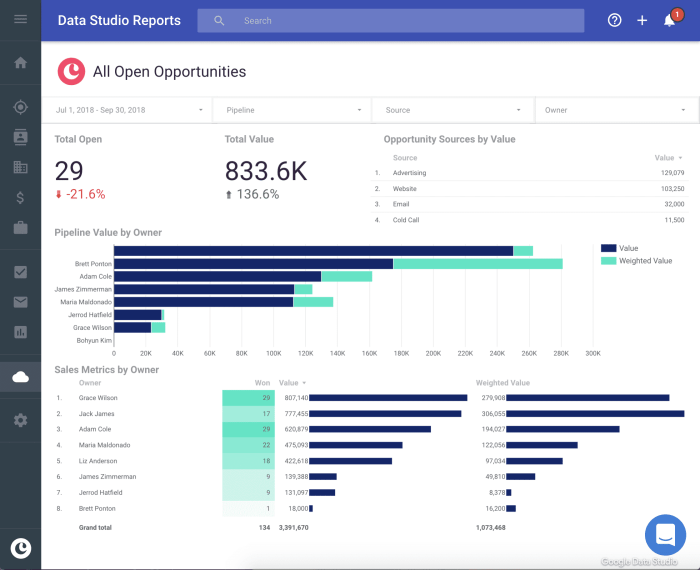

Examples of Reports Improving Decision-Making

The software generates reports on key performance indicators (KPIs) like sales trends, customer acquisition costs, and customer lifetime value. For example, a sales report might reveal a seasonal slump in sales, prompting proactive marketing campaigns. A customer churn report can highlight areas for improvement in customer service, leading to increased retention rates. Profitability analysis reports can identify profitable and unprofitable products or services, informing pricing strategies and inventory management.

Finding the right CRM accounting software for your small business can be a game-changer, you know! To truly optimize your processes, you might want to consider integrating it with a top-notch CRM. Check out this helpful guide on the best crm for small business 2023 to see what fits your needs. Then, you can confidently choose a CRM accounting software that seamlessly works with your chosen CRM, making everything smoother and more efficient for your business, sayang!

Cash flow reports provide real-time insights into the company’s financial health, allowing for proactive adjustments to spending and investment decisions. These reports empower businesses to make informed decisions, optimize operations, and drive growth.

Cost-Benefit Analysis and ROI

Investing in CRM accounting software might seem like a hefty upfront cost, but think of it as a shrewd investment in your business’s future. This section will dissect the financial implications, showing you how the benefits far outweigh the initial expenditure, ultimately boosting your bottom line and freeing up your time for more important things (like that much-needed vacation!).The costs associated with implementing CRM accounting software include the initial software license fee, potential implementation costs (consultants, training), and ongoing maintenance fees.

However, these costs pale in comparison to the potential returns. Let’s delve into the tangible and intangible rewards.

Tangible and Intangible Benefits of CRM Accounting Software

Tangible benefits are the easily quantifiable gains. These are the things you can put a dollar sign on, like reduced labor costs, improved efficiency, and increased revenue. Intangible benefits, on the other hand, are harder to measure directly but are equally crucial to long-term success. These include improved customer relationships, enhanced data insights, and increased employee satisfaction. By combining both, you get a holistic picture of the software’s true value.

Measuring the Effectiveness of CRM Accounting Software

Determining the success of your CRM accounting software hinges on establishing clear Key Performance Indicators (KPIs). These metrics provide a quantifiable measure of how the software is impacting your business. Examples include: reduction in manual data entry time, improvement in invoice processing speed, increase in sales conversion rates, and a decrease in accounts receivable days. By tracking these KPIs over time, you can accurately assess the software’s contribution to increased efficiency and profitability.

Potential Cost Savings Associated with CRM Accounting Software

The following table illustrates the potential cost savings across various aspects of your business. Remember, these are estimates; your actual savings will depend on your specific business operations and the software chosen. Consider these figures as a realistic projection based on industry averages and case studies of similar businesses.

| Area | Cost Savings | Metrics | Examples |

|---|---|---|---|

| Reduced Data Entry Time | 10-20% reduction in labor costs | Hours saved per week, reduction in employee overtime | A company with 5 employees spending 2 hours/week on manual data entry could save $500-$1000 per month at an average hourly rate. |

| Improved Invoice Processing | 5-15% reduction in processing time | Number of invoices processed per hour, days sales outstanding (DSO) | Faster invoice processing translates to quicker payments, potentially freeing up thousands in working capital. |

| Reduced Errors | 5-10% reduction in error-related costs | Number of errors per month, cost of correcting errors | Fewer errors mean less time spent on corrections and fewer financial penalties due to inaccuracies. |

| Enhanced Customer Relationship Management | Increased sales conversion rates (5-15%) | Sales conversion rate, customer lifetime value (CLTV) | Improved customer communication and personalized service can lead to increased customer loyalty and higher sales. |

Integration with Other Business Tools

Imagine your business as a well-oiled machine. Each part – sales, accounting, marketing – needs to work seamlessly with the others for maximum efficiency. That’s where the power of integrated CRM accounting software truly shines. It’s not just about crunching numbers; it’s about connecting the dots between all your vital business functions.Seamless integration between your CRM accounting software and other business applications streamlines operations and minimizes manual data entry, leading to increased productivity and reduced errors.

This integration allows for a holistic view of your business, providing valuable insights that can inform strategic decisions. It’s like having a super-powered dashboard that gives you a bird’s-eye perspective of everything happening in your business, all in one place.

Examples of CRM Accounting Software Integrations, Crm accounting software small business

Several common business tools integrate beautifully with modern CRM accounting software. For instance, e-commerce platforms like Shopify or WooCommerce can directly feed sales data into your accounting system, eliminating the need for manual data entry. Payment gateways such as Stripe or PayPal can automatically reconcile transactions, providing accurate and up-to-the-minute financial information. Marketing automation tools like Mailchimp or HubSpot can sync customer data, allowing for targeted marketing campaigns based on real-time customer behavior and purchase history.

Project management tools like Asana or Trello can also integrate, offering a clear view of project profitability and resource allocation. Imagine effortlessly tracking expenses related to a specific project, all within your CRM accounting software.

Benefits of Seamless Integration

The advantages of this interconnectedness are plentiful. Reduced manual data entry translates directly into time savings, freeing up valuable employee time for more strategic tasks. Automated processes minimize errors, ensuring accurate financial reporting and improved decision-making. A unified view of customer data enables personalized interactions and targeted marketing efforts, leading to increased customer satisfaction and loyalty. Ultimately, seamless integration fosters a more efficient, productive, and profitable business operation.

Challenges in Integrating CRM Accounting Software

While the benefits are undeniable, integrating various systems isn’t always a walk in the park. Data compatibility issues can arise if different systems use different data formats or structures. Security concerns are paramount; ensuring the secure transfer and storage of sensitive data across multiple platforms requires careful consideration and robust security measures. The complexity of the integration process itself can be a challenge, requiring technical expertise or the involvement of third-party integration specialists.

Finally, the cost of integration, including software licenses, implementation fees, and potential ongoing maintenance, needs to be factored in.

Evaluating Integration Capabilities

When evaluating different CRM accounting software packages, carefully examine their integration capabilities. Check for pre-built integrations with the specific tools you use, such as your e-commerce platform or payment gateway. Investigate the software’s API (Application Programming Interface) documentation to understand its ability to connect with other systems. Look for user reviews and testimonials that discuss their experiences with the integration process and any challenges they encountered.

Consider the level of technical support offered by the software vendor to assist with integration and troubleshooting. Remember, a smooth and efficient integration process is crucial for realizing the full potential of your CRM accounting software.