Understanding Long-Term Care Insurance Costs

Long term care insurance cost calculator and comparison – Choosing long-term care insurance can feel like navigating a maze, especially when you’re trying to figure out the costs. It’s a significant financial commitment, so understanding the factors that influence premiums is crucial before you decide. Think of it like choosing a coffe* – you wouldn’t just grab the first one you see, right? You’d consider the blend, the price, and whether it fits your taste.

Long-term care insurance is the same; it needs careful consideration.

Factors Influencing Long-Term Care Insurance Premiums

Several key factors determine your long-term care insurance premiums. These factors interact to create a personalized cost, much like a tailor-made baju bodo. Ignoring these could lead to a surprise bill later, which is definitely

not* something you want.

The most significant factors include your age when you buy the policy (younger is cheaper!), your health status (existing conditions can impact costs), the type of policy you choose (comprehensive policies are generally more expensive), the benefit amount (higher benefits mean higher premiums), and the length of the benefit period (longer periods cost more). Your gender can also play a role, although this is becoming less significant in many areas.

Finally, the insurer itself will have its own pricing structure, so comparing quotes from multiple providers is essential.

Breakdown of Common Cost Components

Let’s break down the typical components that make up your long-term care insurance premium. It’s like understanding the ingredients of a delicious Makassar dish – you need to know what goes in to appreciate the final product.* Benefits: This refers to the amount of daily or monthly coverage the policy provides. Higher benefits mean higher premiums. Imagine it like the size of yournasi kuning* portion – a bigger portion costs more.

-

Policy Type

Traditional policies offer a fixed benefit amount for a specified period, while hybrid policies combine long-term care benefits with life insurance. Hybrids often have higher premiums upfront but can offer additional benefits. Think of it as choosing between a

- simple plate of pisang rai* or a full

- makan siang* with several dishes.

Age

This is a major factor. The younger you are when you purchase the policy, the lower your premiums will be. This is because you have a longer time until you might need the benefits. It’s similar to investing – starting early means you have more time for your investment to grow.

Health

Your current health status significantly influences your premiums. Pre-existing conditions can lead to higher premiums or even denial of coverage. It’s like getting a car insurance quote – a car with a history of accidents will have a higher premium.

Cost Differences Between Policy Types

Traditional long-term care insurance policies typically have lower initial premiums compared to hybrid policies. However, traditional policies only provide long-term care benefits, while hybrid policies offer both long-term care and life insurance coverage. The choice depends on your individual needs and risk tolerance. It’s like deciding between a budget-friendly but less feature-rich phone and a premium smartphone with more functionalities.

Each has its own pros and cons, and the best option depends on your priorities.

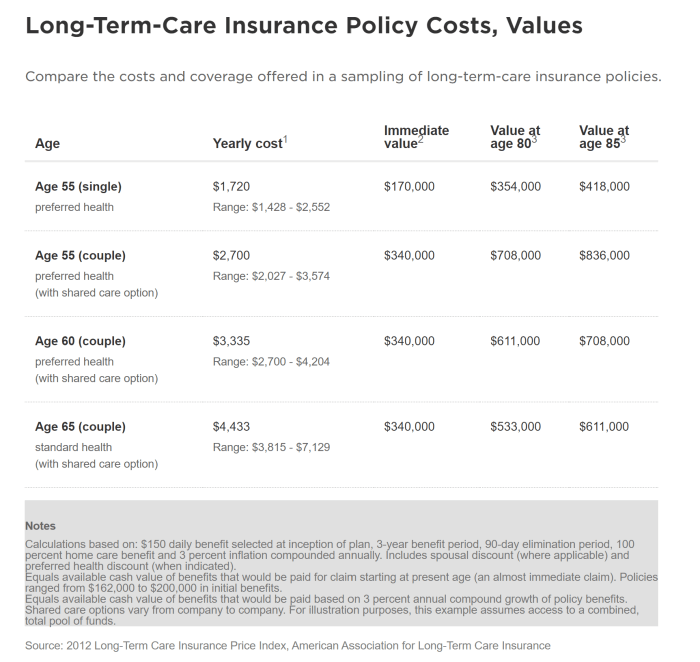

Average Costs of Long-Term Care Insurance Across Different Age Groups

The following table shows estimated average costs. Remember, these are averages and your actual costs will vary based on the factors mentioned above. This is just a general guide, like a rough map to help you navigate the world of long-term care insurance.

| Age Group | Average Annual Premium | Average Monthly Premium | Policy Type |

|---|---|---|---|

| 35-44 | $1,500 | $125 | Traditional |

| 45-54 | $2,500 | $208 | Traditional |

| 55-64 | $4,000 | $333 | Traditional |

| 65+ | $6,000+ | $500+ | Traditional |

Using a Long-Term Care Insurance Cost Calculator

Nah, Bos, planning for long-term care is serious business, especially considering the rising costs. A long-term care insurance cost calculator is your

- mirasa* (friend) in navigating this. It helps you estimate how much you’ll need to pay for potential future care, so you can budget accordingly and avoid future

- susah* (trouble). These calculators aren’t magic, but they provide a valuable snapshot of potential expenses.

Typical Features of Long-Term Care Insurance Cost Calculators

Most long-term care insurance cost calculators offer a range of features designed to provide a personalized estimate. They go beyond simple calculations, incorporating various factors to create a more accurate picture. This allows for better financial planning and decision-making. Think of it as a detailed financial portrait of your future long-term care needs.

Input Parameters Required by Long-Term Care Insurance Cost Calculators

To generate a relevant estimate, these calculators need specific information from you. This data paints a picture of your individual circumstances and risk profile. Think of it like providing the ingredients for a customized recipe. The more accurate the input, the more precise the output.

- Age: Your current age significantly impacts the cost, as older individuals have a higher probability of needing long-term care.

- Health Status: Pre-existing conditions and overall health influence the premium. Someone with pre-existing conditions may face higher premiums.

- Desired Benefit Amount: This refers to the daily or monthly amount you want the policy to cover. Higher benefits mean higher premiums.

- Inflation Protection: This crucial feature accounts for the rising cost of care over time. It ensures your benefits keep pace with inflation, preventing your coverage from becoming inadequate in the future. For example, a policy with 3% annual inflation protection will adjust the benefit amount annually to compensate for rising costs.

- Benefit Period: This specifies the length of time the policy will provide benefits (e.g., 2 years, 5 years, lifetime). Longer benefit periods typically lead to higher premiums.

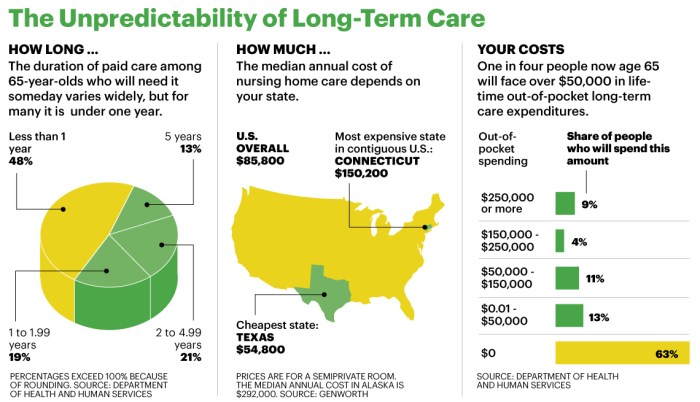

- Location: The cost of long-term care varies significantly by location. Calculators will factor in your state or region’s average costs.

Estimating Future Costs and Adjusting for Inflation

These calculators use actuarial data and statistical models to predict future long-term care costs. They incorporate inflation rates to project how much care will cost in the future. For instance, if the current average daily cost of a nursing home is $300 and inflation is projected at 3% annually, the calculator will estimate a significantly higher cost in 10 or 20 years.

This prevents underestimation and ensures your coverage remains relevant. The formula often looks something like this:

Future Cost = Current Cost

(1 + Inflation Rate)^Number of Years

Step-by-Step Guide to Using a Long-Term Care Insurance Cost Calculator

Using these calculators is usually straightforward, but a step-by-step guide ensures a smooth process.

- Find a reputable calculator: Many insurance companies and independent websites offer these calculators. Ensure the source is trustworthy and uses up-to-date data.

- Gather your information: Before starting, collect all necessary information, such as your age, health status, desired benefit amount, etc. Accuracy here is key.

- Input your data: Carefully enter the required information into the calculator. Double-check for accuracy to avoid errors.

- Review the results: Carefully examine the estimated costs. Understand what the numbers represent and how they’re calculated.

- Compare quotes: Use several calculators to compare estimates. This helps ensure you’re getting a comprehensive understanding of potential costs.

Comparing Long-Term Care Insurance Policies

Nah, choosing long-term care insurance isn’t exactly a beach party, but understanding the differences between policies is crucial to avoid getting stuck with something that doesn’t quite fit your needs. Think of it like choosing the perfect outfit – you wouldn’t wear a tuxedo to a casual hangout, right? Similarly, you need a policy that matches your lifestyle and financial situation.

This section will break down the key differences to help you make an informed decision.

Key Differences Between Policies from Various Insurance Providers

Different insurance providers offer policies with varying features and costs. It’s like comparing different brands of cell phones – some have better cameras, others have longer battery life, and some are just plain cheaper. The same applies to long-term care insurance. Factors like the reputation of the provider, their financial stability, and customer service reviews should all be considered alongside the policy’s features.

Don’t just focus on the price tag; look at the whole package.

Benefits and Limitations of Different Policy Types

Long-term care insurance policies come in various flavors, from comprehensive to limited coverage. A comprehensive policy is like having a full-blown buffet – it covers a wide range of services, including nursing home care, home healthcare, and assisted living. A limited policy, on the other hand, might only cover nursing home care, and possibly only up to a certain daily amount.

Consider your potential needs; if you anticipate needing a broader range of services, a comprehensive policy might be worth the extra cost. Conversely, if your needs are more limited, a less expensive policy might suffice.

Importance of Considering Policy Features Beyond Cost

While cost is a significant factor, don’t let it be the only thing you consider. Think about the benefit period – how long will the policy pay for care? A longer benefit period offers greater peace of mind, but it will typically cost more. The waiting period is another crucial element; this is the time you must wait after becoming eligible for benefits before coverage kicks in.

A shorter waiting period is beneficial, but again, this often translates to a higher premium. These features significantly impact the overall value of the policy.

Comparison of Three Hypothetical Long-Term Care Insurance Policies

To illustrate the differences, let’s compare three hypothetical policies:

- Policy A (Comprehensive): This policy offers comprehensive coverage, including nursing home care, home healthcare, and assisted living. It has a daily benefit of $200, a benefit period of 5 years, and a 90-day waiting period. The annual premium is $3,000.

- Policy B (Limited): This policy covers only nursing home care, with a daily benefit of $150, a benefit period of 3 years, and a 30-day waiting period. The annual premium is $1,500.

- Policy C (Hybrid): This policy provides a balance between comprehensive and limited coverage, including nursing home and home healthcare, with a daily benefit of $175, a benefit period of 4 years, and a 60-day waiting period. The annual premium is $2,200.

Remember, these are just hypothetical examples. Actual policies will vary greatly depending on your age, health, and the insurer. Thoroughly review the policy documents before making a decision.

Illustrating Cost Scenarios: Long Term Care Insurance Cost Calculator And Comparison

Understanding the cost of long-term care insurance requires considering several factors. This section provides illustrative scenarios to clarify how age, benefit period, health status, and the absence of insurance impact your financial picture. Think of it as a “boss-level” guide to navigating the world of long-term care costs.

Age at Purchase and Premium Costs

The age at which you purchase long-term care insurance significantly impacts your premium. Younger individuals generally secure lower premiums due to a longer projected lifespan before needing care. Conversely, older individuals face higher premiums reflecting a shorter time until potential care needs. Imagine this: a 40-year-old might pay significantly less than a 60-year-old for the same coverage. This difference stems from the actuarial calculations used by insurance companies to assess risk.

A simple text-based illustration:“`Age at Purchase | Annual Premium (Hypothetical)

- —————|—————————

- | $1,000

- | $1,500

- | $2,500

- | $4,000

“`These figures are purely illustrative and vary greatly depending on the policy details and the insurer.

Benefit Period and Premium Costs, Long term care insurance cost calculator and comparison

The length of the benefit period – the duration for which the policy pays benefits – directly influences premiums. Longer benefit periods provide more extensive coverage but result in higher premiums. A shorter benefit period offers lower premiums but less financial protection. For example, a policy covering 2 years of care will cost less than one covering 5 years, even with the same daily benefit amount.

This is because the insurer’s risk is reduced with a shorter benefit period.

Health Status and Premium Calculations

An individual’s current health status significantly affects premium calculations. Pre-existing conditions or health concerns can lead to higher premiums or even policy denial. Insurers assess the applicant’s health history and risk profile to determine the likelihood of needing long-term care. Someone with a history of heart disease might face a higher premium compared to someone with excellent health.

This is similar to how health insurance works, where pre-existing conditions are considered.

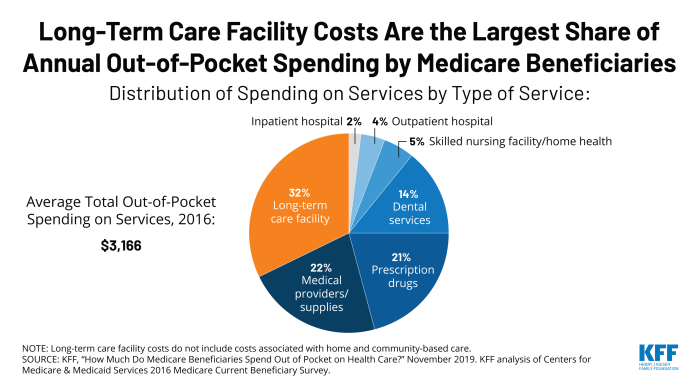

Financial Implications of Not Having Long-Term Care Insurance

Consider a hypothetical scenario: Andi, a 65-year-old Makassar resident, requires long-term care due to a stroke. Without insurance, Andi’s family faces the full cost of nursing home care, potentially exceeding hundreds of thousands of Rupiah per month. This financial burden could deplete savings, force the sale of assets, and significantly impact the family’s financial stability. This scenario illustrates the potential devastation of unforeseen medical expenses without adequate insurance protection.

The absence of insurance can leave individuals and their families vulnerable to substantial financial hardship. This is a real risk, not just a hypothetical one; many families face such situations. The cost of long-term care can quickly bankrupt a family without insurance, especially in the case of prolonged care needs.

Factors Affecting Affordability

Getting long-term care insurance in Makassar, it’s like choosing the right baju bodo – you gotta consider the fit and the price! Affordability depends on a bunch of things, so let’s break down the key factors that can make or break your budget. Understanding these will help you navigate the process like a pro.

Individual Health Conditions and Policy Costs

Your current health significantly impacts your premium. Pre-existing conditions, or even a family history of certain illnesses, can lead to higher premiums or even denial of coverage. Imagine it like this: if you’re already showing signs of needing long-term care, the insurance company assesses a higher risk, thus a higher cost. For example, someone with diagnosed Alzheimer’s disease will face substantially higher premiums than a healthy individual of the same age.

This is because the likelihood of needing long-term care is significantly greater. The insurer needs to factor in the increased probability of a payout.

Family History of Long-Term Care Needs and Premium Influence

Family history plays a big role. If your parents or grandparents needed extensive long-term care, your chances of needing it increase, influencing your premium. This is because genetics and lifestyle often play a role in developing conditions requiring long-term care. For example, a family history of dementia might lead to higher premiums due to the increased risk of developing a similar condition.

The insurer uses this information to assess your risk profile and adjust the premium accordingly.

Financial Planning and Savings for Long-Term Care Insurance Costs

Smart financial planning is crucial. Think of it as preparing for a long and potentially expensive journey. Having savings set aside specifically for long-term care insurance premiums can significantly ease the burden. Consider setting up a dedicated savings account or investment plan specifically for this purpose. This allows for manageable monthly payments and avoids financial strain in the future.

For instance, saving a consistent amount each month, even a small amount, can accumulate into a substantial sum over time, reducing the financial impact of premiums. A well-structured financial plan, considering retirement savings and other expenses, can further help manage these costs effectively.

Strategies for Making Long-Term Care Insurance More Affordable

There are ways to make it easier on your wallet. Consider buying the policy when you’re younger and healthier – premiums are generally lower. Exploring different policy options, such as shorter benefit periods or higher deductibles, can also reduce costs. You can also shop around and compare quotes from multiple insurers to find the best deal, just like you’d compare prices at Pasar Butung before buying your favorite kain tenun.

Another strategy involves paying premiums annually instead of monthly; this often comes with a discount. Finally, looking into government assistance programs or employer-sponsored long-term care benefits can also help lower the overall cost.