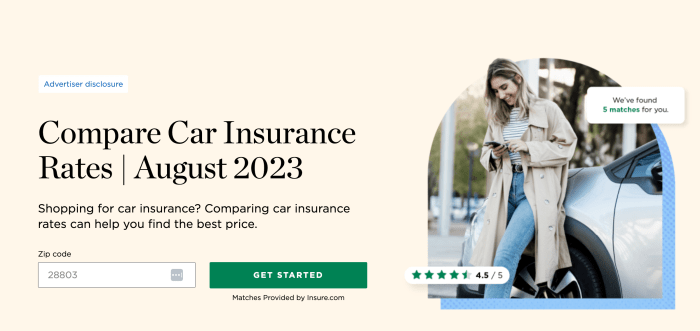

NerdWallet’s Car Insurance Comparison Tool Functionality

Nerdwallet.com car insurance – Embark on a journey of financial enlightenment with NerdWallet’s car insurance comparison tool. This digital compass guides you through the often-murky waters of insurance quotes, illuminating the path to potential savings and peace of mind. It’s a tool designed not just to compare prices, but to empower you with knowledge, fostering a deeper understanding of your insurance needs.

The tool’s functionality rests on a foundation of transparency and ease of use. Its design prioritizes intuitive navigation, allowing even the most insurance-averse individual to confidently explore their options. This accessibility is a key component of its spiritual purpose: to empower the user, reducing the stress and anxiety often associated with finding the right car insurance.

User Interface Design

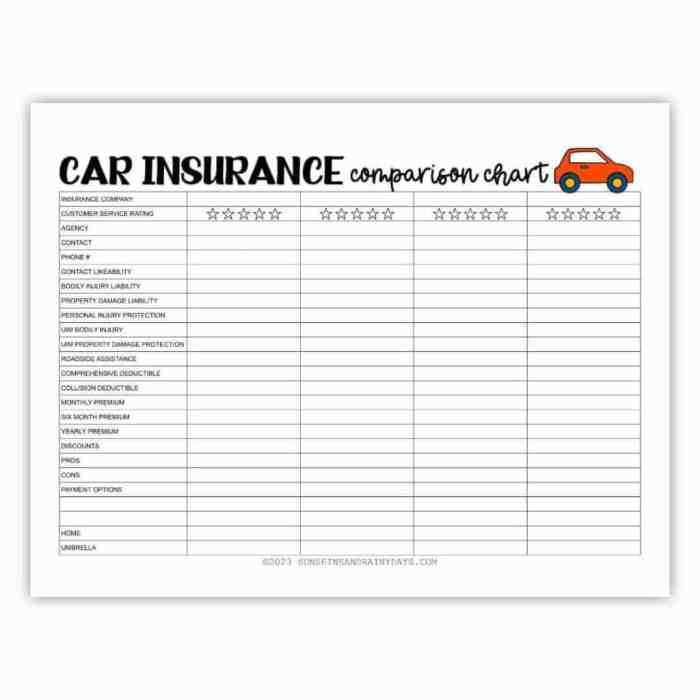

The user interface is designed with simplicity and clarity in mind. The following table details key features, their descriptions, advantages, and potential drawbacks.

| Feature | Description | Pros | Cons |

|---|---|---|---|

| Search Functionality | Allows users to input various criteria, including zip code, driving history, car details, and coverage preferences. | Quick and efficient filtering of results; tailored to individual needs. | Requires accurate information input; may not account for all nuanced factors. |

| Quote Comparison Display | Presents quotes from multiple insurers in a clear, side-by-side format. | Easy visual comparison of prices and coverage details. | Can become overwhelming with a large number of quotes. |

| Coverage Explanation | Provides definitions and explanations of different coverage types. | Educates users on the intricacies of car insurance policies. | May be too simplistic for users with advanced insurance knowledge. |

| Customer Reviews | Integrates user reviews and ratings for different insurance providers. | Provides valuable insights from other customers’ experiences. | Reviews can be subjective and may not always reflect current realities. |

Obtaining a Car Insurance Quote

The process of obtaining a quote is designed to be straightforward and intuitive, a guided meditation on finding the best financial fit for your needs. Follow these steps to achieve enlightenment in your insurance search:

- Visit the NerdWallet car insurance comparison tool page.

- Enter your zip code and other requested information, such as your driving history and the details of your vehicle.

- Select your desired coverage options.

- Review and compare the quotes presented.

- Click on a quote to view more details from the insurer’s website.

Distinction from Other Tools

NerdWallet’s tool distinguishes itself from competitors through its commitment to transparency and user education. This isn’t just about finding the cheapest policy; it’s about finding the best policy for

-you*.

- Comprehensive Coverage Explanations: NerdWallet goes beyond simply displaying prices; it provides detailed explanations of different coverage options, empowering users to make informed decisions.

- Emphasis on User Reviews: The integration of user reviews adds a layer of social proof, helping users gauge the reliability and customer service of different insurers.

- Focus on Financial Literacy: The tool is designed not only to find quotes but also to educate users about car insurance, promoting financial well-being.

- Data-Driven Approach: NerdWallet leverages its vast database of insurance information to provide accurate and up-to-date quotes.

Insurer Coverage Options Presented on NerdWallet: Nerdwallet.com Car Insurance

NerdWallet acts as a digital dharma wheel, turning to reveal the karmic consequences of various car insurance choices. By comparing quotes from multiple providers, it illuminates the path towards financial prudence and peace of mind. This process allows consumers to find the best coverage at the most suitable price, fostering a sense of balance in their financial lives.

Understanding the diverse offerings of car insurance providers is akin to comprehending the multifaceted nature of reality itself. Each insurer presents a unique tapestry of coverage options, woven from threads of risk assessment and financial responsibility. Navigating this complexity requires discernment and careful consideration.

Major Car Insurance Providers Featured on NerdWallet

The following list represents a selection of the major car insurance providers frequently featured on NerdWallet’s platform. These companies represent a cross-section of the market, offering diverse coverage options and price points. It’s crucial to remember that availability may vary by location.

- State Farm

- Geico

- Progressive

- Allstate

- USAA

Comparison of Car Insurance Coverage from Selected Providers

The table below compares the coverage types offered by three prominent providers. Remember that specific coverage details and prices are subject to change and vary based on individual circumstances. This table offers an illustrative overview, not a definitive guide.

| Provider | Coverage Type | Description | Price Range (Illustrative) |

|---|---|---|---|

| State Farm | Liability | Covers bodily injury and property damage to others in an accident you cause. | $500 – $1500 per year |

| State Farm | Collision | Covers damage to your car in an accident, regardless of fault. | $300 – $1000 per year |

| Geico | Comprehensive | Covers damage to your car from non-accident events (e.g., theft, vandalism, hail). | $200 – $700 per year |

| Geico | Uninsured/Underinsured Motorist | Protects you if you’re hit by an uninsured or underinsured driver. | $100 – $400 per year |

| Progressive | Liability | Covers bodily injury and property damage to others in an accident you cause. | $400 – $1200 per year |

| Progressive | Medical Payments | Covers medical expenses for you and your passengers, regardless of fault. | $100 – $300 per year |

Factors Influencing NerdWallet’s Price Quotes, Nerdwallet.com car insurance

The price quotes generated by NerdWallet for different insurers are influenced by a complex interplay of factors. These factors work together, much like the elements of nature, to create a unique price for each individual.

Consider the driver’s profile as the central sun of this system. Factors such as age, driving history (including accidents and violations), credit score, location, and the type of vehicle all exert gravitational pull, shaping the final quote. A clean driving record, for instance, is like a planet orbiting closely to the sun, resulting in lower premiums. Conversely, multiple accidents or violations would push the planet further out, leading to higher costs.

The type of car, a powerful sports car versus a fuel-efficient compact, also significantly impacts the quote, reflecting the inherent risk associated with each vehicle. Location plays a role because insurers assess risk based on accident rates and crime statistics in different areas. Finally, the credit score acts as a measure of financial responsibility, influencing the insurer’s perception of risk.

In essence, NerdWallet’s algorithm acts as a sophisticated astrologer, meticulously charting the celestial dance of these variables to predict the ultimate cost of insurance. The resulting quote reflects a holistic assessment of the risk associated with each individual driver and their circumstances.

NerdWallet’s Methodology for Ranking and Presenting Insurers

The journey to finding the perfect car insurance policy can feel like navigating a labyrinth. NerdWallet aims to illuminate this path, offering a transparent and data-driven approach to comparing insurers. Their methodology, while not a perfect oracle, strives to provide consumers with a clear view of their options, allowing for informed decision-making based on individual needs. Understanding their ranking system is key to unlocking its true potential.

NerdWallet’s ranking system is a complex tapestry woven from various threads of data, each contributing to the overall picture. It’s not a simple matter of picking the cheapest option; instead, it’s a holistic assessment balancing cost with crucial coverage details. The system aims to present a balanced perspective, allowing users to prioritize based on their personal values and financial circumstances.

Criteria Used for Ranking and Displaying Car Insurance Providers

The criteria used by NerdWallet are multifaceted, reflecting the diverse needs and priorities of car insurance consumers. A clear understanding of these factors is essential for interpreting the rankings effectively. It’s a blend of quantitative and qualitative assessments, striving for a balanced representation of insurer performance.

- Average Customer Satisfaction Scores: NerdWallet incorporates customer satisfaction ratings from reputable sources to reflect the overall experience of policyholders. Higher scores indicate greater customer happiness and a potentially smoother claims process.

- Financial Strength Ratings: The financial stability of the insurer is a critical factor. NerdWallet considers ratings from agencies like AM Best, ensuring that the companies presented have the capacity to meet their obligations.

- Coverage Options: The breadth and depth of coverage offered by each insurer are weighed. This considers factors like liability limits, comprehensive and collision coverage, and optional add-ons.

- Pricing and Discounts: While cost is a significant factor, it’s not the sole determinant. NerdWallet considers average premiums and the availability of various discounts, reflecting the potential for cost savings.

- Claims Process Efficiency: The ease and speed of handling claims are incorporated, drawing on data and reviews to assess the insurer’s responsiveness and fairness in settling claims.

Potential Biases and Limitations of NerdWallet’s Ranking System

While NerdWallet strives for objectivity, it’s important to acknowledge the inherent limitations of any ranking system. The methodology, while robust, is susceptible to certain biases and limitations that users should be aware of to interpret the results effectively. Understanding these potential shortcomings empowers users to engage with the data critically and make informed decisions.

One potential bias stems from the reliance on publicly available data. Not all aspects of insurer performance are equally transparent, leading to potential gaps in the information used for ranking. Furthermore, the weighting given to different criteria might inadvertently favor certain types of insurers. For instance, a heavier emphasis on price might disadvantage insurers with superior customer service but higher premiums.

The dynamic nature of the insurance market also poses a challenge, as rankings can shift based on changes in pricing, coverage options, and customer satisfaction levels.

Another limitation is the inherent difficulty in capturing the nuances of individual experiences. Aggregated data might mask significant variations in customer satisfaction based on factors like geographic location or specific claim circumstances. Finally, the methodology may not fully account for the evolving needs and priorities of diverse consumer groups, potentially leading to a ranking that doesn’t perfectly reflect the unique requirements of every individual.

Hypothetical Scenario Illustrating the Impact of User Inputs on Insurer Rankings

To illustrate how user inputs affect rankings, consider two hypothetical users: User A, a young driver with a clean driving record seeking minimum liability coverage, and User B, an older driver with a history of minor accidents seeking comprehensive coverage including uninsured motorist protection. Both users reside in the same state and utilize NerdWallet’s comparison tool.

User A’s search will likely prioritize insurers offering low premiums for basic liability coverage. The ranking will heavily favor insurers known for competitive pricing in this segment. Conversely, User B’s search will emphasize insurers with robust coverage options and a proven track record of handling claims efficiently. Insurers with strong financial strength ratings and high customer satisfaction scores in handling complex claims will likely rank higher for User B, even if their premiums are slightly higher than those preferred by User A.

This scenario demonstrates how personalized user inputs significantly shape the presented rankings, highlighting the tool’s adaptability to individual needs.

User Experience and Features of NerdWallet’s Car Insurance Section

Navigating NerdWallet’s car insurance section offers a journey of discovery, a quest for the optimal coverage at the most favorable price. The site’s design aims to empower users with knowledge, guiding them through the often-complex world of auto insurance with clarity and efficiency. This exploration will delve into the user experience, highlighting both the strengths and areas for potential improvement.

The overall user experience is generally positive, presenting a clean and intuitive interface. The initial questionnaire is straightforward, requiring only essential information to generate personalized quotes. The presentation of results is clear, allowing for easy comparison across various insurers. However, the sheer volume of information can sometimes feel overwhelming, particularly for users unfamiliar with insurance terminology. For example, the detailed explanations of coverage options, while helpful, might be better organized for quicker comprehension by novice users.

A visual comparison tool, perhaps using bar graphs or color-coded indicators, could enhance this aspect.

Most Useful Features of NerdWallet’s Car Insurance Comparison Tool

Several features stand out as particularly helpful in simplifying the car insurance selection process. These tools streamline the search, transforming a potentially daunting task into a manageable and even enjoyable experience. Their efficacy lies in their ability to empower users with control and transparency.

- Personalized Quotes: The ability to receive customized quotes based on individual circumstances is a key strength. This personalized approach eliminates the need to sift through irrelevant options, focusing the user’s attention on the most relevant plans.

- Side-by-Side Comparison: The clear and concise comparison of quotes from different insurers allows for a quick assessment of price and coverage differences. This feature is crucial for informed decision-making, highlighting the value proposition of each insurer.

- Detailed Coverage Explanations: While potentially overwhelming for some, the detailed explanations of different coverage types are invaluable for users seeking a deeper understanding of their options. This empowers users to make truly informed decisions.

Least Useful Features of NerdWallet’s Car Insurance Comparison Tool

While the majority of the features are beneficial, certain aspects could be improved to enhance the overall user experience. These areas represent opportunities for refinement, aligning the tool more closely with the needs and preferences of a broader user base.

- Lack of Visual Aids: The absence of visual aids, such as charts or graphs to illustrate coverage differences, can make it challenging for some users to quickly grasp the key distinctions between plans. A visual representation could significantly improve comprehension.

- Overwhelming Amount of Information: The abundance of detailed information, while helpful, can be overwhelming for less tech-savvy users. A more tiered approach, allowing users to choose the level of detail they wish to see, would be beneficial.

- Limited Customization of Comparison Results: The ability to customize the displayed columns in the comparison table would improve the user’s ability to focus on the most important factors for their specific needs. This added level of control would make the tool even more user-friendly.

Improved Feature: Interactive Coverage Builder

A significant improvement would be the introduction of an “Interactive Coverage Builder.” This feature would guide users through a series of interactive questions and scenarios, allowing them to customize their coverage based on their individual needs and risk profiles. The tool would dynamically adjust the quote based on user selections, providing real-time feedback and visualization of the impact of each choice.

For example, selecting “increased liability coverage” would immediately show the change in premium and a visual representation of the expanded coverage limits. The tool would also provide clear explanations of each coverage option within the context of the user’s specific choices, ensuring transparency and understanding.

Illustrative Examples of Car Insurance Scenarios on NerdWallet

NerdWallet’s car insurance comparison tool acts as a compassionate guide, illuminating the path toward finding the optimal coverage for diverse life journeys. It transcends mere price comparison; it’s a holistic assessment of individual needs, aligning financial prudence with personal peace of mind. The tool empowers users to navigate the complexities of insurance with clarity and confidence.

The following examples demonstrate how NerdWallet’s tool caters to various profiles, offering personalized insights and facilitating informed decisions. Each scenario highlights the user-friendly interface and the depth of information provided, ultimately fostering a sense of control and understanding in what can often feel like a confusing process.

Car Insurance Scenarios and NerdWallet’s Response

The table below illustrates how NerdWallet processes different driver profiles, showcasing the tool’s adaptability and comprehensive nature. The results are illustrative and may vary based on specific details and real-time market conditions.

| Scenario | User Input | Resulting Quotes | Analysis |

|---|---|---|---|

| Young Driver (21 years old, new driver) | Age, driving history (clean), car make and model (Toyota Corolla), location (California), desired coverage (minimum liability) | Quotes ranging from $1500 to $2500 annually, from various insurers. | NerdWallet displays a range of quotes, highlighting the higher premiums associated with young, inexperienced drivers. It also provides detailed explanations of the factors influencing the pricing, such as age and driving history, enabling the user to understand the cost structure. |

| Senior Driver (65 years old, clean driving record) | Age, driving history (clean), car make and model (Honda Civic), location (Florida), desired coverage (comprehensive and collision) | Quotes ranging from $800 to $1200 annually, with variations based on insurer discounts for senior drivers. | NerdWallet showcases how insurers often offer discounts to senior drivers with clean records. The tool clearly presents these discounts and explains the factors contributing to the lower premiums, fostering a sense of appreciation for responsible driving habits. |

| Driver with Multiple Accidents (35 years old, two accidents in past three years) | Age, driving history (two accidents), car make and model (Ford F-150), location (Texas), desired coverage (full coverage) | Quotes significantly higher than average, with a potential range from $2500 to $4000 annually, depending on the severity of the accidents. | NerdWallet transparently reveals the impact of past accidents on insurance premiums. It provides clear explanations of how the accidents affect the risk assessment and the resulting cost increase, empowering the user to understand the consequences of their driving history and take proactive steps to improve their profile in the future. |

NerdWallet’s Policy Detail Display

Upon selecting an insurer from the presented quotes, NerdWallet provides a detailed breakdown of the policy. Imagine a visually clean layout with clear headings for each coverage type (liability, collision, comprehensive, etc.). Each coverage section displays the specific limits, deductibles, and the associated cost. A summary table at the bottom neatly consolidates all the coverage details and the total premium.

This detailed breakdown removes ambiguity and allows for a thorough comparison across different insurers, empowering users to make informed decisions based on their specific needs and budget.

Addressing Specific User Needs and Preferences

NerdWallet’s intuitive design allows for the seamless integration of specific needs. For example, if a user owns an eco-friendly car and seeks environmentally conscious insurers, they can input this information during the initial search. The tool will then filter the results, presenting only insurers that offer discounts or specialized programs for green vehicles. This tailored approach ensures that the user’s values align with their insurance choice.

Similarly, users with specific coverage requirements, such as uninsured/underinsured motorist coverage above the state minimum, can specify these needs. The tool will then filter the results to show only insurers offering the desired coverage options. This step-by-step process ensures that the user finds a policy that completely meets their requirements.