Defining Term Life Insurance and Whole Life Insurance

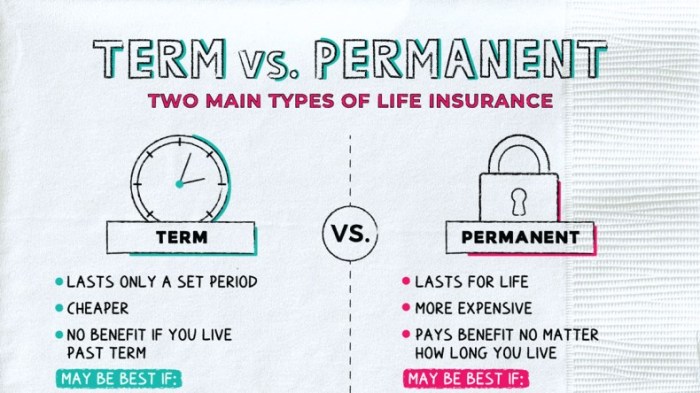

Term life insurance vs whole life insurance cost comparison – Understanding the core differences between term life and whole life insurance is crucial for making an informed decision about which policy best suits your individual needs and financial goals. Both offer death benefit protection, but they differ significantly in their coverage duration, cost structure, and the presence or absence of a cash value component.

Term life insurance and whole life insurance represent distinct approaches to life insurance coverage. The primary difference lies in the duration of coverage and the inclusion of a cash value component. Let’s examine each type in detail.

Term Life Insurance

Term life insurance provides coverage for a specified period, or “term,” such as 10, 20, or 30 years. If the insured dies within the term, the beneficiary receives the death benefit. If the insured outlives the term, the policy expires, and coverage ceases unless renewed (often at a higher premium). Term life insurance policies generally offer higher death benefit coverage for a lower premium compared to whole life insurance, making them an attractive option for those seeking affordable coverage for a specific period, such as while raising a family or paying off a mortgage.

Whole Life Insurance

Whole life insurance provides lifelong coverage, meaning the death benefit is paid whenever the insured dies, regardless of when that occurs. A key differentiator is the accumulation of cash value. A portion of each premium payment goes towards building a cash value component that grows tax-deferred over time. This cash value can be borrowed against or withdrawn under certain conditions, providing a potential source of funds for future needs.

However, whole life insurance premiums are generally higher than term life insurance premiums due to the lifelong coverage and cash value accumulation features.

Comparison Table

The following table summarizes the key differences between term life and whole life insurance:

| Policy Type | Coverage Duration | Cash Value | Premium Payments |

|---|---|---|---|

| Term Life Insurance | Specific term (e.g., 10, 20, 30 years) | None | Lower, level premiums for the term |

| Whole Life Insurance | Lifelong | Accumulates tax-deferred | Higher, level premiums for life |

Cost Factors Influencing Premiums

Understanding the cost of life insurance, whether term or whole life, requires examining several key factors. These factors interact to determine the premium you’ll pay, and recognizing their influence can help you make informed decisions about your coverage. The cost differences between term and whole life insurance are largely driven by the fundamental differences in their structures and the risks they cover.

Several interconnected factors significantly influence the premiums for both term and whole life insurance policies. These factors are often weighted differently depending on the type of policy and the insurer’s risk assessment models.

Age

Age is a primary determinant of life insurance premiums for both term and whole life policies. As you age, your risk of mortality increases, leading to higher premiums. This is a fundamental principle of actuarial science, upon which insurance pricing is based. For example, a 30-year-old applying for a term life policy will typically pay significantly less than a 50-year-old applying for the same coverage amount.

Similarly, whole life insurance premiums, which are paid throughout the life of the policy, reflect this age-related risk; premiums are generally higher for those who purchase the policy at an older age.

Health

An applicant’s health status plays a crucial role in determining premiums. Insurers assess health through medical questionnaires, sometimes including medical exams. Individuals with pre-existing conditions or a family history of certain illnesses may face higher premiums or even be denied coverage altogether. This is because they present a higher risk to the insurer. For both term and whole life policies, a healthier applicant will typically qualify for lower premiums.

Smoking Status

Smoking significantly increases the risk of various health problems, including heart disease and cancer, leading to a higher mortality rate. Consequently, smokers generally pay substantially higher premiums for both term and whole life insurance than non-smokers. The increased risk associated with smoking is consistently reflected in insurance pricing models across most insurance companies.

Coverage Amount

The amount of life insurance coverage you choose directly impacts your premium. A larger death benefit means a higher premium, as the insurer is assuming a greater financial obligation. This relationship is relatively straightforward and applies equally to term and whole life policies: the more coverage you seek, the more you’ll pay. For example, a $500,000 term life policy will cost more than a $250,000 policy, all other factors being equal.

Policy Riders and Add-ons

Policy riders and add-ons, which provide additional benefits or features beyond the basic coverage, will increase the overall cost of both term and whole life insurance. These add-ons, such as accelerated death benefits or long-term care riders, increase the insurer’s potential payout, thus justifying a higher premium. For instance, adding a disability waiver rider to a term life policy, which ensures premium payments are waived if the policyholder becomes disabled, will increase the policy’s cost.

Similarly, adding a guaranteed insurability rider to a whole life policy, allowing for increases in coverage amount without further medical underwriting, will result in higher premiums.

Premium Payment Structures and Comparisons

Understanding the premium payment structures for term and whole life insurance is crucial for making an informed decision. The flexibility and long-term cost implications differ significantly between these two types of policies. Choosing a payment structure that aligns with your financial capabilities and long-term goals is paramount.

Both term and whole life insurance offer various premium payment options, influencing the overall cost and your monthly budget. Term life insurance premiums are generally fixed for the policy’s duration, while whole life insurance premiums can remain level or fluctuate depending on the specific policy design. Let’s examine these structures in more detail.

Term Life Insurance Premium Payment Structures

Term life insurance premiums are typically characterized by their simplicity. Payments are usually made monthly, quarterly, semi-annually, or annually. The premium amount remains consistent throughout the policy’s term, providing predictable budgeting. However, it’s important to remember that the coverage ends at the expiration of the term, unless renewed, at which point premiums will likely increase significantly due to age and health factors.

Whole Life Insurance Premium Payment Structures

Whole life insurance offers more diverse payment options. Level premium policies maintain a constant premium payment throughout the insured’s life, offering predictability. However, some whole life policies allow for flexible premium payments, where the policyholder can adjust the payment amount within certain limits. This flexibility can be beneficial during periods of financial uncertainty, but it also carries the risk of potentially lapsing the policy if payments fall significantly short of what’s required to maintain the coverage.

Furthermore, increasing premium whole life policies will start at a lower amount and gradually increase over time. This approach can be attractive initially, but the premiums can become substantial in later years.

Premium Payment Structure Comparison

The following table illustrates examples of different payment structures and their cost implications over 10 and 20 years. Remember that these are illustrative examples and actual premiums will vary based on factors such as age, health, coverage amount, and the insurance company.

| Policy Type | Payment Frequency | Premium Amount Example (Annual) | Total Cost Over 10 Years | Total Cost Over 20 Years |

|---|---|---|---|---|

| 10-Year Term Life | Annual | $500 | $5,000 | N/A (policy expires) |

| 10-Year Term Life | Monthly | $42 (approx.) | $5,040 | N/A (policy expires) |

| Whole Life (Level Premium) | Annual | $1,200 | $12,000 | $24,000 |

| Whole Life (Level Premium) | Monthly | $100 (approx.) | $12,000 | $24,000 |

| Whole Life (Increasing Premium) | Annual | Starting at $800, increasing annually | Approximately $9,000 – $11,000 (depending on increase rate) | Approximately $20,000 – $28,000 (depending on increase rate) |

Note: The increasing premium example is approximate. The actual cost will depend on the specific rate of premium increase Artikeld in the policy contract. This rate is usually specified by the insurance company and can vary significantly based on various factors.

Level vs. Increasing Premiums: Long-Term Cost Implications

The choice between level and increasing premiums significantly impacts long-term costs. Level premiums offer predictable budgeting, making financial planning easier. However, the consistent cost can be higher than the initial cost of an increasing premium policy. Increasing premiums, while initially attractive due to lower starting costs, can become substantially higher over time, potentially impacting financial stability later in life.

A thorough evaluation of one’s financial projections is essential before opting for an increasing premium policy.

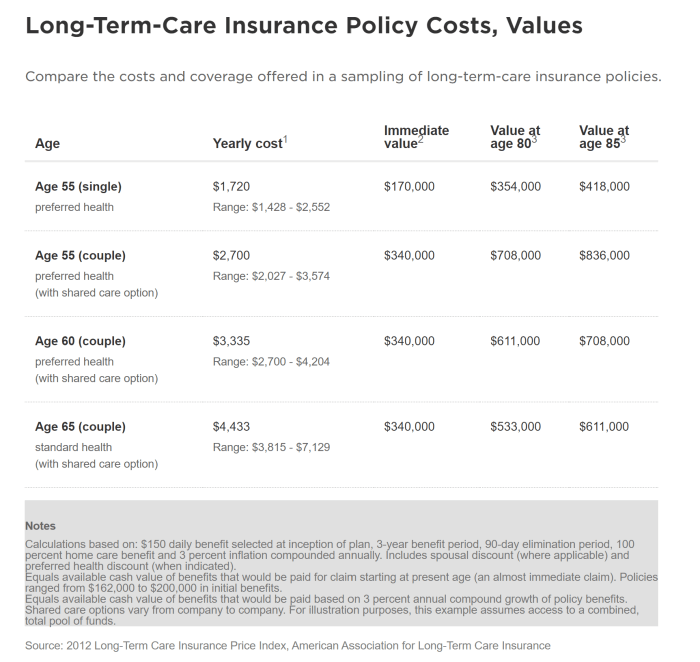

Long-Term Cost Analysis: Term Life Insurance Vs Whole Life Insurance Cost Comparison

Understanding the long-term financial implications of term life insurance versus whole life insurance is crucial for making an informed decision. This analysis considers the total cost over a 20-year period, factoring in coverage amounts and potential renewal scenarios. The goal is to provide a clear picture of the cumulative financial commitment associated with each policy type.

A direct comparison of term and whole life insurance costs over an extended period reveals significant differences. While initial premiums for term life insurance are substantially lower, the costs can fluctuate significantly over time due to renewal or lapse. Whole life insurance, conversely, offers consistent premiums throughout the policy’s duration, though at a higher initial cost. This section will illustrate these cost dynamics with specific examples.

Comparative Costs Over 20 Years

The following illustrates the total cost of each policy type over a 20-year period, considering different coverage amounts. These figures are illustrative and actual costs will vary based on individual factors such as age, health, and the insurance company.

| Policy Type | Coverage Amount ($1,000,000) | Annual Premium (Estimate) | Total Premium (20 Years) | Coverage Amount ($500,000) | Annual Premium (Estimate) | Total Premium (20 Years) |

|---|---|---|---|---|---|---|

| Term Life (20-Year Term) | $500 – $1000 | $10,000 – $20,000 | $200,000 – $400,000 | $250 – $500 | $5,000 – $10,000 | $100,000 – $200,000 |

| Whole Life | $750 – $1500 | $15,000 – $30,000 | $300,000 – $600,000 | $375 – $750 | $7,500 – $15,000 | $150,000 – $300,000 |

Note: These are illustrative examples only. Actual premiums will vary widely based on individual circumstances and the specific insurance provider. It is crucial to obtain personalized quotes from multiple insurers for an accurate cost comparison.

Cost Changes Upon Term Life Insurance Renewal or Lapse

A key difference lies in how the cost of term life insurance behaves over time. Unlike whole life, term life insurance policies have a limited duration. At the end of the term, the policy expires. Renewal is typically possible, but at a significantly higher premium reflecting the increased risk associated with older age. For example, a 30-year-old purchasing a 20-year term policy might see their premiums increase substantially upon renewal at age 50.

Alternatively, if the policy lapses, coverage ceases entirely. This creates a potential gap in coverage that requires careful planning.

Long-Term Cost Advantages and Disadvantages

The long-term cost advantages and disadvantages of each policy type are directly related to premium payments and the presence or absence of cash value accumulation.

- Term Life Advantages: Lower initial premiums, making it more accessible for budget-conscious individuals. Suitable for those needing coverage for a specific period (e.g., mortgage repayment).

- Term Life Disadvantages: Premiums increase significantly upon renewal, potentially becoming unaffordable. No cash value accumulation; premiums are solely for death benefit coverage.

- Whole Life Advantages: Consistent premiums throughout life, providing predictable long-term costs. Cash value accumulation builds over time, potentially offering loan options or tax-advantaged withdrawals.

- Whole Life Disadvantages: Higher initial premiums, making it a more expensive option upfront. Cash value growth may not always keep pace with inflation.

Illustrative Examples

Understanding the financial implications of term life insurance versus whole life insurance requires considering individual circumstances. The following scenarios illustrate how policy type and cost projections vary depending on life stage and needs. Remember that these are illustrative examples, and actual premiums will vary based on individual health, age, and the insurer’s specific pricing.

To provide clarity, we will project costs over a 20-year period, a common timeframe for comparing these insurance types. This allows for a comprehensive cost comparison, factoring in premium increases over time.

Scenario-Based Cost Projections

Below, we present three distinct scenarios, each highlighting the suitability of either term or whole life insurance and providing estimated premium costs.

| Scenario | Policy Type | Estimated Annual Premium | Total Cost Over 20 Years |

|---|---|---|---|

| Young Family (30-year-old, $500,000 coverage) | Term Life Insurance (20-year term) | $1,000 | $20,000 |

| Young Family (30-year-old, $500,000 coverage) | Whole Life Insurance | $3,000 | $60,000 |

| Single Individual (35-year-old, $250,000 coverage) | Term Life Insurance (10-year term) | $500 | $5,000 |

| Single Individual (35-year-old, $250,000 coverage) | Whole Life Insurance | $1,500 | $30,000 |

| Retired Couple (65-year-old, $200,000 coverage per person) | Term Life Insurance (10-year term, likely unavailable due to age) | N/A – Likely Unavailable | N/A |

| Retired Couple (65-year-old, $200,000 coverage per person) | Whole Life Insurance (existing policy) | $2,000 (per person) | $40,000 (per person) |

Note: These premium estimates are for illustrative purposes only. Actual premiums will depend on several factors including health status, smoking habits, occupation, and the specific insurance company. The unavailability of term life insurance for the retired couple at their age reflects the reality that term life insurance is typically offered to younger, healthier individuals. For older individuals, whole life insurance or other alternative solutions might be more appropriate.

Scenario Details:

- Young Family: This scenario emphasizes the need for substantial coverage to protect dependents. Term life insurance provides affordable coverage for a defined period, aligning with the family’s need for protection during their children’s formative years. Whole life insurance, while providing lifelong coverage, comes at a significantly higher cost. The choice often depends on the family’s financial priorities and risk tolerance.

- Single Individual: A single individual might prioritize affordability. A shorter-term policy like a 10-year term life insurance offers a cost-effective way to address immediate needs. Whole life insurance, though offering lifelong coverage, may be considered less crucial for a single individual without dependents.

- Retired Couple: This scenario highlights the importance of pre-existing coverage. At age 65, securing new term life insurance is often difficult and expensive, if not impossible. Whole life insurance, if already held, provides continued coverage and peace of mind, though the premiums can be substantial. It is crucial to consider existing policies and financial planning in retirement.

Death Benefit and Cash Value Comparisons

Understanding the differences in death benefit payouts and the presence or absence of cash value is crucial when comparing term life and whole life insurance. Both offer a death benefit, but their structures and additional features differ significantly, impacting long-term financial planning.The core distinction lies in the nature of the death benefit and the inclusion of a cash value component.

Term life insurance provides a pure death benefit, payable only upon the death of the insured within the policy’s specified term. Whole life insurance, conversely, offers a death benefit alongside a cash value component that grows over time.

Death Benefit Payout, Term life insurance vs whole life insurance cost comparison

Term life insurance policies offer a straightforward death benefit payout. Upon the death of the insured during the policy’s term, the designated beneficiary receives the predetermined death benefit amount. This amount remains constant throughout the policy’s duration. Whole life insurance, however, also provides a death benefit, but this benefit can increase over time due to the accumulating cash value.

The final death benefit paid out is typically the face value of the policy plus any accumulated cash value. The payout process is similar for both: the beneficiary files a claim with the insurance company, providing necessary documentation to verify the death and beneficiary information. The payout timeframe can vary depending on the insurer and the efficiency of the claims process, but generally aims to be swift and efficient to assist the beneficiary during a difficult time.

Cash Value Accumulation in Whole Life Insurance

Whole life insurance policies feature a cash value component that grows tax-deferred. This means that the earnings on the cash value are not taxed until withdrawn. The cash value builds up over time through a portion of the premiums paid. Policyholders can typically borrow against this cash value, or withdraw it under certain circumstances, though withdrawals may impact the death benefit.

For example, a $100,000 whole life policy might accumulate $20,000 in cash value after 10 years, depending on the policy’s terms and the insurer’s investment performance. This accumulated cash value can provide a source of funds for various needs, such as education expenses or retirement planning, although it is crucial to understand the potential tax implications of withdrawing or borrowing against it.

It is important to consult a financial advisor to determine the best strategy for utilizing the cash value component.

Tax Implications of Whole Life Insurance Cash Value

While the growth of the cash value in a whole life insurance policy is tax-deferred, withdrawals and loans can have tax implications. Withdrawals are generally taxed as ordinary income to the extent that they exceed the policy’s cost basis (the total premiums paid). Loans against the cash value are not taxed, but any outstanding loan balance reduces the death benefit payable to the beneficiary.

For example, if a policyholder borrows $10,000 against a $100,000 policy with a $20,000 cash value, the death benefit would be reduced to $90,000. Understanding these tax implications is crucial for proper financial planning and to avoid unexpected tax liabilities. Careful consideration should be given to the tax implications before making any withdrawals or loans against the cash value.